Holding our breaths for European Milk Supplies

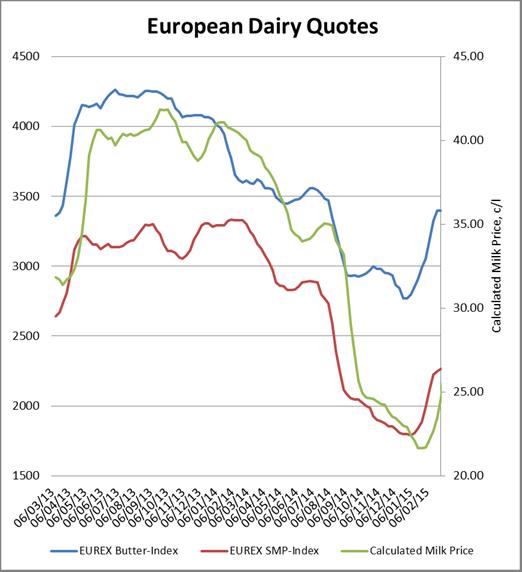

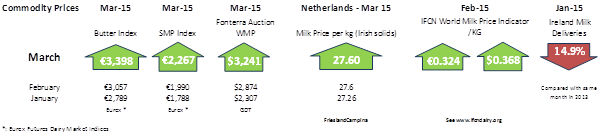

The recent strengthening of European and global dairy markets is extremely welcome, and, for now, seems to be sustained. The Eurex index has been strengthening since the new year began, and has risen from its low point, equivalent to about 21.7c per litre, to somewhere around 28.7c for standard Irish constituents. The Commission has estimated an EU wide reduction in milk deliveries of about 3% in the first quarter of 2015, some of which is due to quota constraints, and some of which is due to poor prices. In addition, the Commission note a significant reduction on the butterfat content of milk across the Member States.

The question on everyone’s lips is whether on 1st April, the expected surge in milk due to quota elimination will overwhelm the price driven supply constraint. The introduction of volume limited pricing systems in France and the UK, and the, still weak, milk prices paid in Germany may moderate any dramatic supply increases in the Union.

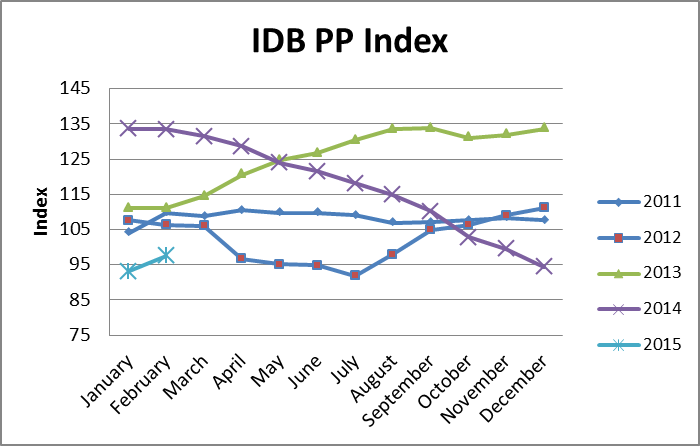

The Irish Dairy Board (soon to be renamed Ornua) Purchase Price Index has risen from 93.1 to 97.5. This is a further indication of confidence in the market, and is significantly ahead of where the IDB had been guiding before Christmas. It still suggests a milk price below 30c per litre, but the positive move is to be welcomed.

In the U.K. First Milk announced their A and B pricing structure for April. They said that the A price, for 80% of a supplier’s milk, would be 20.87p/l for the manufacturing pool and 20.5p/l for the balancing pool (formerly classified as the liquid pool) from April. The B price will range from 16-18p/l and would be fixed after the month-end. The move has been roundly criticised by farm leaders who question the message it gives to markets as well as the lack of confidence which First Milk has in its own position. It comes as First Milk confirms that its CEO Kate Allum will be leaving the co-operative.

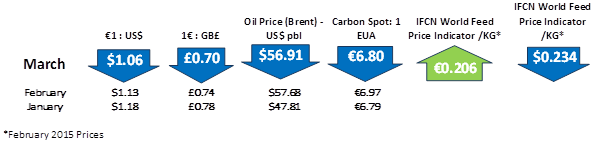

Meanwhile, the GDT auction continues to recover, with last week’s auction showing stability at current levels, with the TWI growing by 1.1%. WMP prices dropped by 1% to $3241 (€3058 at today’s dollar rate). Butter prices rose by 2.5% to $3912 (€3691 at today’s rate, or €300 above European prices), and SMP prices rose by 5.9% to $2935 (€2767 at today’s rate, or €500 above European prices).

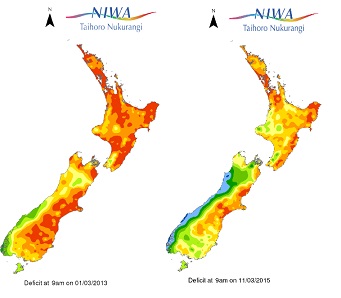

The ongoing New Zealand drought has been credited with spooking buyers, to an extent, and forcing them onto the market to take some cover for supplies. The extent of the drought, however, shouldn’t be overstated, as the comparison between the Soil Moisture deficit maps for New Zealand in March 2015 versus March 2013 (courtesy of the NZ National Institute of Water and Atmospheric Research) demonstrate.

Industry milk production statistics for January show NZ milk production running at 0.3% ahead of the previous January, having run at 4-5% ahead for the earlier part of the season. While anecdotal reports suggest a dramatic drop-off in February and March, these have yet to be confirmed.