Markets Quiet as Prices Remain Flat

Dairy markets continue to be very weak as Europe passes its peak and milk supplies remain strong. Milk supplies, internationally, are expected to show growth on last year, despite the poor start to the 2015 season. Generally low product prices have prompted some demand growth, which will help, to some extent to absorb production growth however; European milk prices are expected to come under significant downward pressure in order to reflect the current market returns.

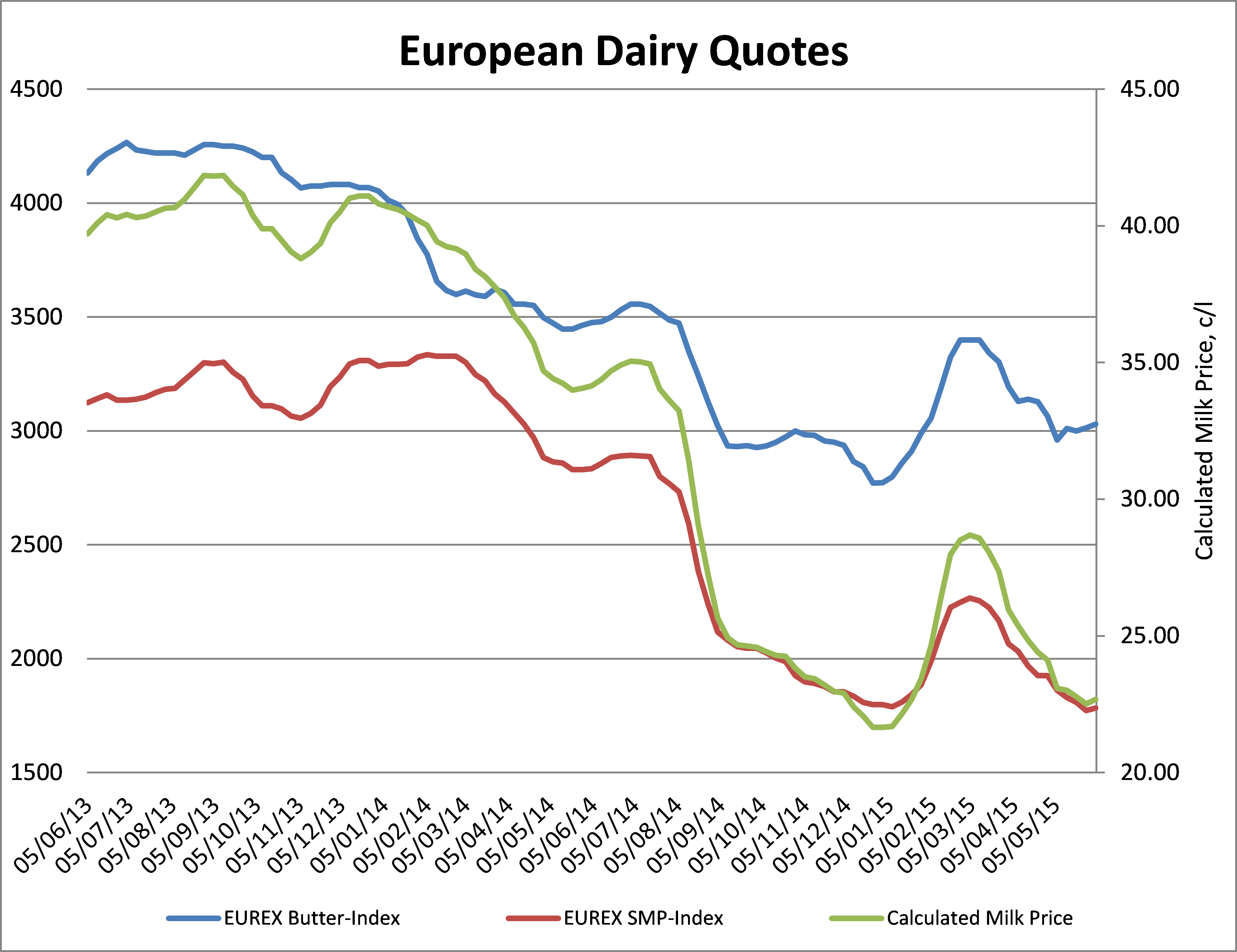

Current butter and SMP quotes from the Eurex exchange of €3,020 and €1,783 respectively, would appear to support milk prices of around 24c per litre including VAT, almost exactly the same value as at the same time in June 2012, although then butter prices were weaker and SMP prices stronger. Currently, sentiment around butter markets seems reasonably positive, with low stock levels being held and sellers not appearing under pressure to shift stock. On the other hand, SMP markets are teetering around intervention level, although the fact that there isn’t much serious talk of intervention buying might suggest that sellers are reasonably confident that their stocks (big and all as they are) might be worth a little more in a few months’ time.

None-the-less, the fact that the European Commission is predicting supply growth for the full year and the current strong supplies in the UK, Germany, Netherlands, Ireland, as well as the US, and the strong season end in the Southern Hemisphere, would demonstrate that buyers currently have the upper hand. It remains to be seen whether those buyers decide to do some business before the summer holiday season. If they do, it might give the market the shot in the arm it needs.

Meanwhile DairyNZ, suggest that milk income for the average kiwi dairy farmer will be about $1/kg of milk solids below the cost of production this season. This is reported to represent a deficit of $1.7b to $2b at for the country as a whole, to be drawn from cash reserves or borrowings. On the basis of Fonterra’s opening forecast of $5.25/kg, the advance of $3.66 for the new season and the lack of retro payments from last season, DairyNZ calculated income of $4.75/kg MS. But the production cost was calculated at $5.70, including farm working expenses, interest and rent, tax, drawings and capital expenditure.