Market Weakness Continues as Commission Stand Back

Current dairy market weakness seems set to persist as the Russian import ban is extended, global milk production grows, and the GDT auction takes a hammering.

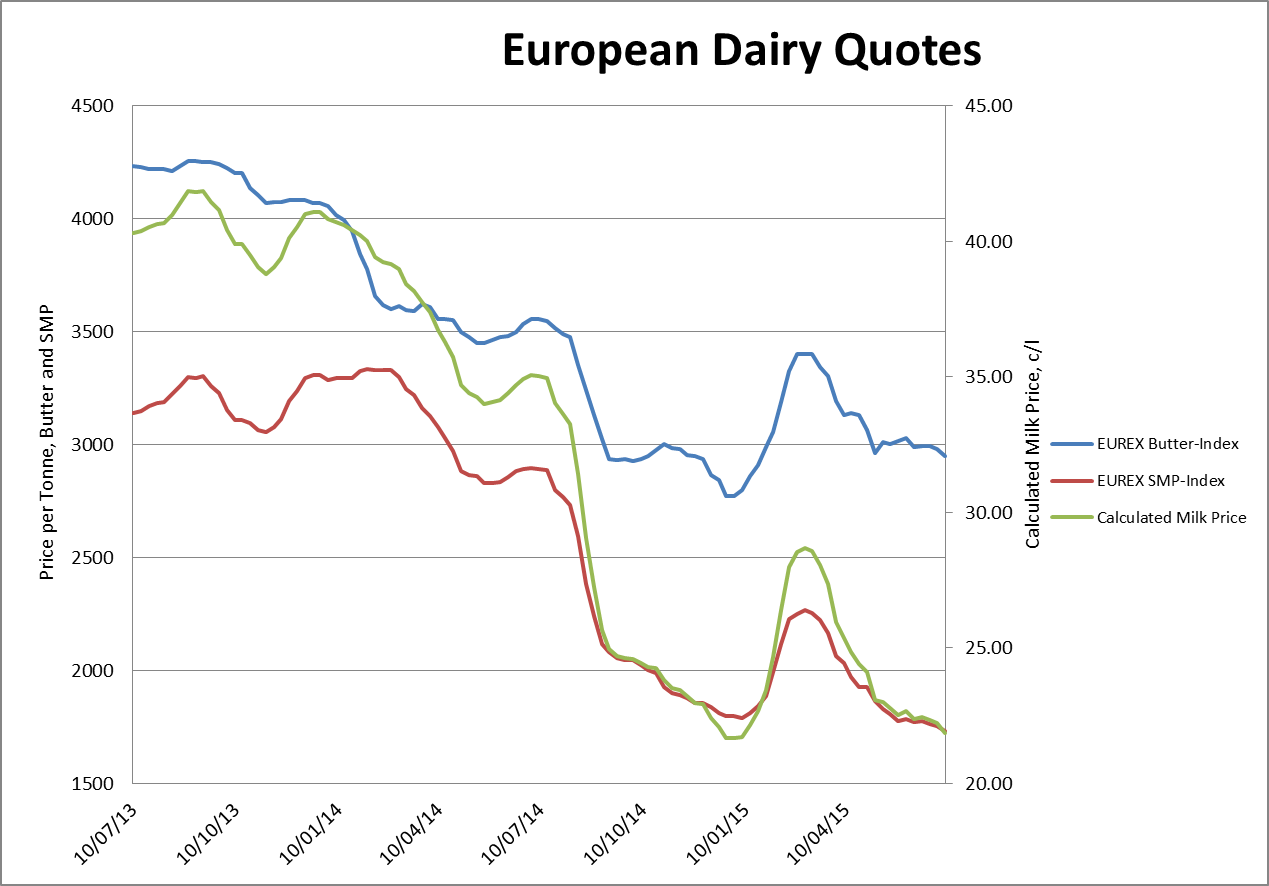

This week’s EEX indices (formerly published by Eurex) value butter at €2948 with SMP trading at €1732. On the basis of these spot values, milk could be calculated at having a spot value of around 23c including VAT. The fact that Irish milk prices are currently hovering significantly above this level is due to product being forward sold at higher prices and our evolved product mix which has taken us further away from base commodities in recent years.

The Ornua Purchase Price Index for June dropped to 95.3, down from 98.3 for May. The drop is said to reflect lower returns across all products, as well as the expiry of previous higher returning contracts.

According to the New Zealand Dairy Exporter, this week, the price of whole milk powder, could drop further at next week’s GlobalDairyTrade auction as New Zealand starts to ramp up production amid a global glut in milk supply. The publication goes on to say that since the July whole milk powder futures contract last traded on the NZX at US$1910 a tonne, and because the price was an average of two fortnightly auctions and the contract was priced at US$2000 a tonne in last week’s auction, traders predict a decline of 10% to US$1800 a tonne next week.

In response to pressure from MEP’s (covered in a separate story), Commissioner Hogan reminded those listening that the CAP is equipped with a far reaching toolkit of measures available for addressing the particular constraints of the milk sector. He resisted calls for increased intervention prices or for the activation of export refunds. He also rubbished calls, from some quarters, for a reinstatement of milk quotas or other supply management tools. The logic from the Commission is that milk supplies must reduce in response to market weakness, and that low prices will trigger the reduction. Wrongly timed intervention in the market would, they believe, interfere with the necessary pricing signals which farmers should receive. While the Commissioner is probably technically correct in his analysis, that’s cold comfort for farmers who, in their first year of expansion, will be facing massive drops in their incomes.

If all the current indicators are correct, and the current market weakness persists for the full season, the Commissioner can expect significant farmer unease across Europe, as well as some shrill voices looking for the reinstatement of quotas.

By TJ Flanagan

Dairy Policy Executive