Markets Commentary

Market sentiment is much improved with supply factors more muted and demand factors firm to positive.

Milk flows in January were down -0.9% year on year. Milk flows in France (-3.4%) and Germany (-1.7%) were down year on year, the two largest milk producing nations in the EU-27. ICOS attended the European Milk Market Observatory Economic Board Meeting on 23rd March. The Commission is forecasting milk production to grow by 1% in 2021, with some experts suggesting a lower forecast of between 0.6% and 1%. Milk production is forecast to grow by +4% in Ireland in 2021 by the Commission. US milk production increased in January (+1.6%) and February (+2%) but less than expected. Milk flows in New Zealand are on a par with the previous year (+0.8% June-January) and Australian flows are modest (+1.4% June-January).

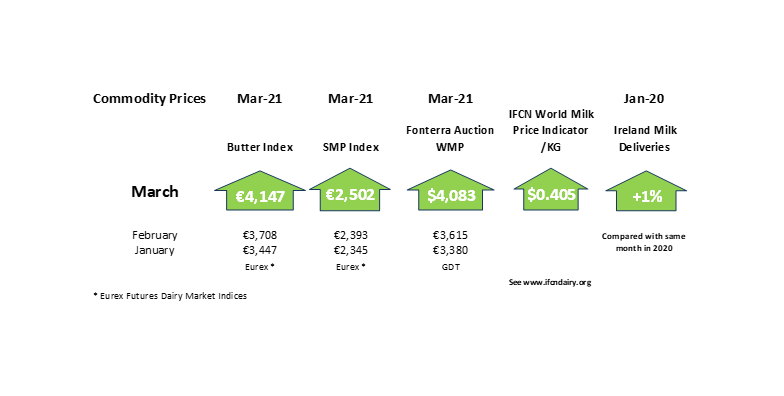

Retail and export demand continues to offset the impact of COVID-19 on the foodservice sector. The rollout of the COVID-19 vaccination and restocking ahead of the reopening of food service are important factors, although fears of a COVID-19 fourth wave highlight the uncertainty of the pandemic. Trade costs associated with freight and container supply issues are also factors. The temporary suspension of US-EU tariffs and the postponing of UK import checks are positive in the short term. The EEX butter index is at €4,147/tonne, with the Dutch quotation at €4,050/tonne. The SMP EEX index is at €2,502/tonne.

Eamonn Farrell – Agri Food Policy Executive