Market Commentary

Milk flows are subdued across the main dairy producing regions, which is behind the buoyant levels in international prices for all dairy products.

Global milk supply remains tight despite very strong milk prices. Global supply is projected to remain in-check with modest increases only forecasted in the EU (+0.7%) and US (+0.8%) in 2022, mainly due to the impact of rising input costs. Globally, milk collections are projected to increase by +0.6% in 2022. Milk flows are forecast to fall by -1.2% in the UK for their 2021/22 season.

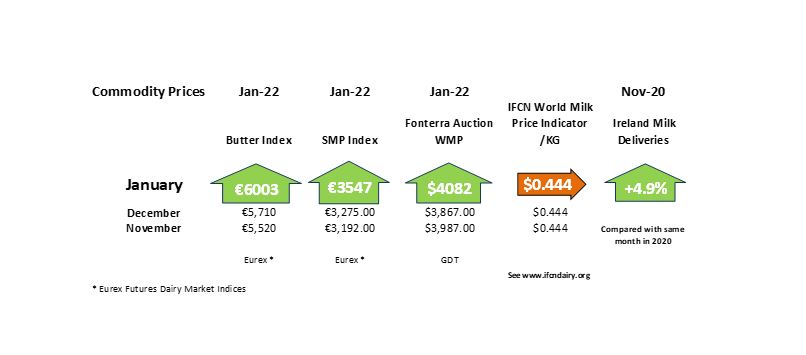

The retail market is showing signs of returning to pre-pandemic times, although supply chain challenges and the impact of variants of concern remain. Cheddar pricing has strengthened against the backdrop of weaker supply and solid demand. The presence of Chinese buying is underpinning demand especially for milk powders. The GDT reached its highest point since March 2014, with WMP prices up 21% year on year; combined with lower output, this has led to a revised Fonterra milk price forecast of between $8.40-$9 kg of MS.

Source: Global Dairy Trade