Markets: Continued Weakness, Supply Slow-down Needed

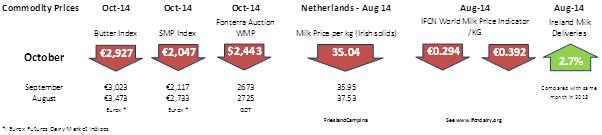

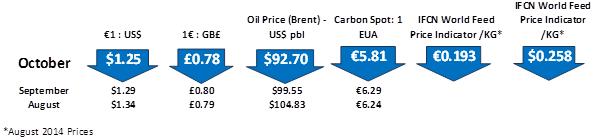

European dairy markets continue to weaken, although perhaps the pace has fallen off, somewhat. Last week’s Eurex quotes were around 3% down on a month ago, effectively signalling another 1c per litre drop in milk value, down to about 24.5c per litre at Irish constituents. Skim Milk Powder, valued at just a whisker over €2000 per tonne is trading close to the low point of May 2012 (€1978 per tonne then), and it’s also almost identical to the New Zealand GDT price ($2450, or €2032 at today’s exchange rate). Butter, on the other hand, at just under €3000 per tonne (according to Eurex), is still trading at a €900 plus premium to the New Zealand auction price, although the gap is narrowing, helped by the weak Euro.

Meanwhile, the GDT auction continues to take a hammering, with last week’s Index dropping by another 7.3%. Their butter and SMP prices at $2415 and $2540 respectively, would suggest a milk price of about $21.75 for Irish constituents. Meanwhile Fonterra have forecast their milk price for the current 2014/15 season at $5.30 per kg m.s., the lowest in six years. That equates to about 22.5c per litre. Earlier in this season, farmers had the opportunity to lock in a price of $7 per kg (29.8c/litre)for a limited volume.

Notwithstanding the disastrous effects of Russian ban, the fundamental problem is a cyclical one, whereby global supply and demand are out of line. In the absence of climatic or feed supply issues, which might periodically be expected to slow down milk supply, we are now dependent on either a strong low price signal to suppliers to reduce supplies, or, in the case of the EU, the impending super levy. In addition, at the current price levels, dairy ingredients are very attractive versus competitors, and dairy consumption should be attractive, particularly in emerging nations. Indeed, sellers note that demand for Irish product remains very strong (important in the context of next spring’s expected surge), but that buyers are happy to only lock in their short term needs, in the hope that prices for new spring might weaken. Observers believe that the prospects for the market are quite strong, with balance between supply and demand expected sometime mid-2015. In the mean-time, however, farmers need to ensure that their own business plans are robust enough to weather this current period of low prices. Thankfully, Irish farmers got the vast majority of this year’s production out in wonderful grass growing conditions and record prices. It’s the southern hemisphere farmers who are absorbing the worst of this current crisis.