Market Returns Continue to Drop

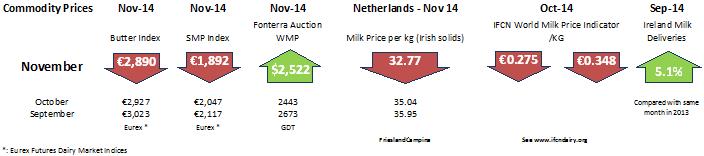

As we come to the end of the 2014 supply year, the continuing deterioration in dairy markets shows no real sign of easing. The current Eurex Indices for Butter and SMP, at €2,980 and €1,892 respectively, suggest milk values of around 23.4c per litre. While Irish processors are paying well above those levels, they are trading off contracts written many months ago, and new contracts, for spring 2015 supply will reflect the Eurex Indices quite closely. This time last year, Eurex was reporting prices suggestive of a milk price of just over 39c per litre. The Eurex European quoted prices France, Germany and the Netherlands. The current reported butter price is still 34% above the Intervention buying-in price of €2217.5, however, the Skim Milk Powder quote price is only 8% above the Intervention level of €1746.9. Meanwhile, the GDT auction of November 4th reflected a further slight drop, although the WMP price stabilised at $2,522, or equivalent to about 19.5c per litre for Irish constituents.

Milk supplies remain strong in the key territories, with the US reporting a 4% increase in September, and New Zealand struggling to deal with a peak supply which is up by 4.5% on last year. In total, global milk supply for the year to September is up by 4.3%. European supply growth will moderate for the trough period, as low prices and milk quota restrictions bite at farm level.

Meanwhile, the predicted market recovery by Q3 of 2015 seems less certain. The ongoing low feed cost outlook, combined with a strong internal market will continue to drive US production and exports. China, who’s imports were curtailed by high stock levels, seem to be making slower headway in eating into those stocks, and in parallel, have been investing in internal supply, thereby reducing their need for imports. Farmers would be well advised to take a very conservative approach to their business plans for 2015, and to budget for lower than expected milk prices for much of the year.