Are We at the Bottom? How Long will it Last?

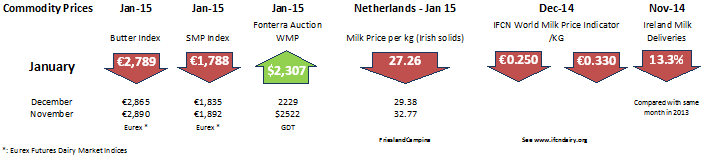

We need to start hoping that dairy markets are actually at rock bottom right now. Eurex reported butter and SMP prices of €2798 and €1788 are suggestive (depending on how you do the calculations) of a spot milk value of just over 21.5c per litre.

This is lower than at the weakest point in 2012 (in mid-late May 2012 Eurex was suggestive of milk vales at about 21.9c per litre). In 2012 the market recovered quite rapidly from that point, as poor weather combined with low milk prices and high feed prices to kill off supply. It remains to be seen whether the current low prices will pinch off supply growth in Europe.

Certainly the current difficulties in the UK market, particularly for high cost liquid producers, may dampen their current enthusiasm. The recent First Milk announcement may also demonstrate that the business model may not be as robust as they would have wished. None-the-less, the UK looks likely to finish the quota year strongly with milk supplies expected to 10% above the 5-year average for the final quarter of the year.

There is some slowdown in the pace of growth, although it is too early to comment definitively. UK milk supplies for the full quota year are expected to reach the highest level total in the past 20 years, exceeding 14 billion litres, still some way short of their total quota of about 15.3 billion litres.

Meanwhile, the IDB Purchaes Price Index for December has continued to slide, with a further 5% drop to 94.5. This index level still suggests milk prices of over 28c per litre, and it might be expected to drop further, in line with the c27c guidance issued by many industry authorities.

The first GDT auction of the new year yielded a 3.6% increase bringing the average weighted price to $2,709/tonne, the highest in nearly 5 months. Price increases were seen across all products, with butter rising by 13.2% and SMP and WMP rising by 2.8% and 1.6% respectively. While these rises give some cause for optimism that we have reached the turning point, they must be seen in the context of lowering volumes as per the New Zealand season.

Meanwhile the “US All-Milk” price has started to decline, down to $20.3 in December, still equivalent to about 39c per litre, but down about 10c per litre since September.

It needs to be emphasised that the international customers of the Irish dairy industry are still looking for our product, and are keen to see volumes built up, in line with our 2020 projections. The problem is that current price at which they want to write contracts is determined by global trade prices, and currently they are in the mid 20’s range. This is the unfortunate reality of price volatility. We should not be put off in our expansion ambitions, as we need volume to have influence in increasingly globalised markets. We need however, to put structures in place to allow farmers and Co-ops to deal with these cruel price cycles.