Have We Dodged A Bullet?

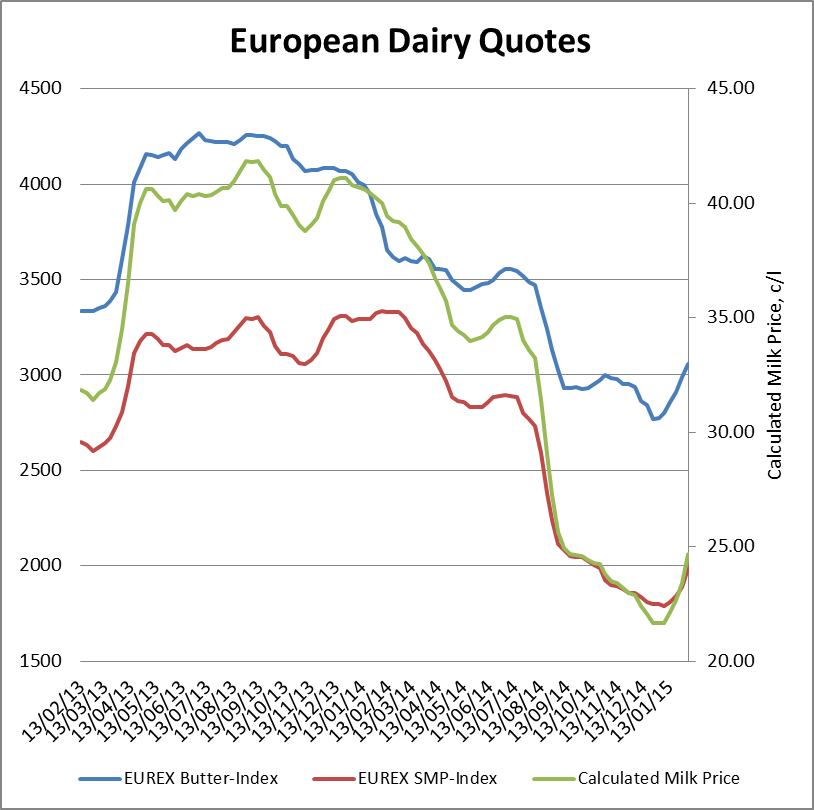

Let us be in no doubt, dairy markets are still quite weak, with price quotes suggesting we’re still a long way off the highs of 2013 and early 2014. In the past month, however, there’s been a significant tightening of markets, with Eurex butter and SMP quotes having risen by 10.3% and 11.3% respectively. The higher quotes, €3057 for butter and €1990 for SMP, would value milk at around 24.7c per litre plus VAT. That’s still a shockingly bad milk value, but it’s 3c above what it was last month.

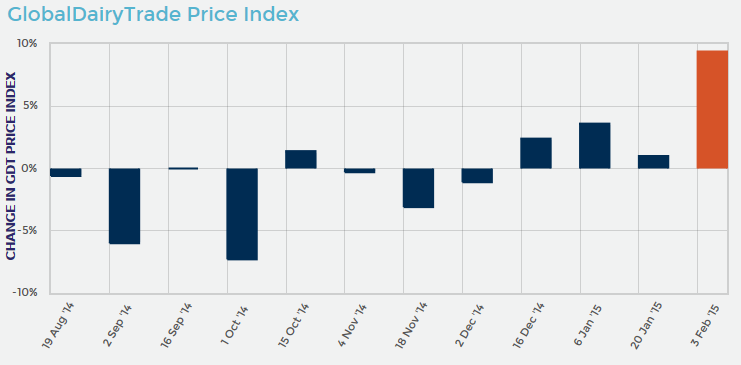

There is no question but the strengthening European sentiment is influenced by the expected impact of low milk prices and dry weather on New Zealand milk supplies. GDT auction results are strengthening with an average of 20% increase since mid-December. A combination of prolonged dry weather, dwindling grass, high beef prices, and poor milk price suggests that culling is a more attractive option for Kiwi dairy farmers.

At the end of January Fonterra announced that it had revised its milk volume forecast down by 3.3% below last year’s, from a position a month earlier where production was on par with the previous season. For the first half of the season (June to Dec) New Zealand milk production had been running over 5% ahead of the previous year. The subsequent drop-off must, however, be seen in the context of a very strong second half, last year, where record milk prices drove production. NZX report volumes of cows culled to January this year have been 37% higher than normal, with prices 20% higher than the year earlier.

In addition, Fonterra have announced that it is reducing the volume of WMP available on the GDT auction. Volumes for the remainder of this season will be over 40% less than the previous season.

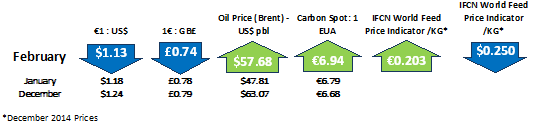

Meanwhile UK milk production has slowed down and is now running at just over 1% above last year. This is thought to be caused by a combination of cold weather and low prices. The weak euro, while a help to Irish producers, is damaging UK producer prospects.

It must be remembered that US milk production is still growing by over 3% per annum, and that we are about to see a milk supply surge post April. Also, we still have the Russian embargo, and the Chinese don’t seem to have gotten back into buying powder. Therefore, we need to take a balanced view on market prospects, but as of now, it would appear that we, luckily, hit the worst of the bear market just as we were out of production, and we may see somewhat stronger markets as we come back into supply.