Dairy Markets – Any Sign of Recovery?

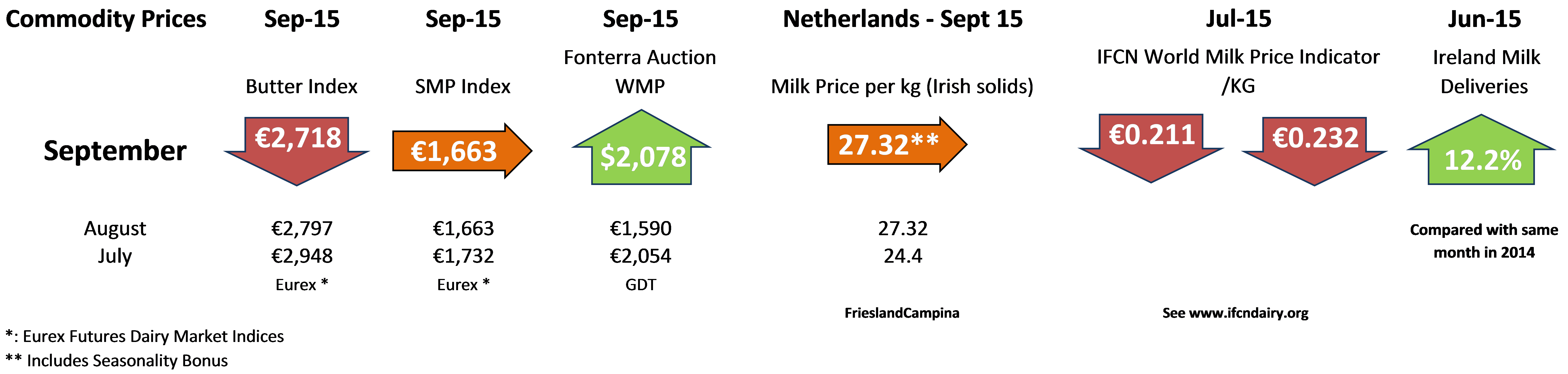

Dairy markets seem to be bouncing along the bottom at present, with European SMP quotes (at €1663) hovering at around the intervention price level, and butter continuing to weaken, if anything, at €2718. Those quotes, if translated into milk prices, would put a value on Irish milk of around 22c including VAT.

At current milk prices, ICOS estimates that the industry has supported Irish farm gate milk prices to the tune of €100 million over the past year. While Co-ops are happy to support suppliers during period market downturns, the extent of the support extended so far, and the possible requirement for ongoing support, has to be worrying for all concerned.

The Ornua PPI continues to weaken, though at a slower rate. The August index is 91.5, down just marginally from 91.8 in July. We can see the clear difference between this year’s weakness and the 2012 curve. In 2012 markets started to recover in late summer as European supplies were affected by a cold, wet summer and US production was hit by a record drought. Unfortunately, such events haven’t arisen this year, although the reports of drought effects in the French and Polish maize crops may hold out some hope for a tightening in feed markets. Early reports of overstated crop yields may also lead to some strengthening of markets.

Meanwhile, last week’s GlobalDairyTrade auction boosted hopes for market recovery in prices, with a 10.9% index increase, and a WMP price of $2078. Analysts suggest that forward pricing for SMP and WMP point to bidders not expecting dramatic increases in the medium term. Butterfat also continued to strengthen, with AMF up 11.7% and butter up 8.1%. Volumes were down by 37% on the previous year.

Meanwhile the US Dairy Export Council says that they “don’t think real recovery is at hand.” They blame “Unrelenting milk production growth and heavy inventories” saying that they’ll “continue to weigh on the global dairy market, forestalling a meaningful price recovery until at least mid-2016”. That’s according to Marc Beck, executive vice president of strategy and insights for the USDEC. They define ‘recovery’ as whole milk powder (WMP) prices returning to $3000/ton on a sustainable basis and they report current Oceania WMP prices in a range of $1850-2200/tonne. They cite the main drivers responsible for the 2015 milk surplus—increased milk production and reduced imports from China and Russia—have put an additional 13 million tons of milk on the world market over the last year. “For the 12 months ending June 2015, milk production from the five major dairy exporters (the EU-28, New Zealand, United States, Australia and Argentina) was 5.6 million tons greater than the previous year. China’s imports were down about 4.6 million tons, milk equivalent, and Russia’s imports were down another 2.8 million tons, milk equivalent. So that’s a net supply increase of 13 million tons of milk, which the rest of the world has been unable to absorb.” The outlook is for continued weakness as supply slowly rebalances.

“Milk production worldwide continues to increase,” the USDEC says. Output from the five major dairy exporters was up more than two percent in the second quarter. “We expect production to be up 1 to 2 percent in the second half of the year as well,” he adds.

Meanwhile, China’s own milk production is reportedly up about 4 percent this year. This excess milk is being diverted into powder, which is accumulating in inventory, Beck says. “No one knows for sure, but we’ve seen estimates that China could still be sitting on 300,000 to 400,000 tons of powder in inventory.

By TJ Flanagan, Dairy Policy Executive