Dairy Market Recovery? Signs are Positive!

There are now reasonably consistent signs of a strengthening in dairy markets, with the EEX index for butter and SMP both rising steadily across the past month. Butter quotes, at €2872 are running at over €150 up on the month and the SMP quoted price at €1762, although still close to intervention level, is running around €100 up on last month. Those prices would value milk at around 22-23c per litre, still well below current milk price levels, but moving slowly upwards none-the-less. This relative strength is undoubtedly down to buyers concern that milk supply growth is slowing down, as it appears to be across all the major regions. The post quota supply growth in the EU, which came from “2nd tier” nations, such as Ireland, Poland, the UK and the Netherlands, is expected to tail off as the year progresses, and, crucially, the big producer nations such as France and Germany are seeing production declines. The US is expected to see around only 1.4% growth for the year, and New Zealand, as will be discussed below, is also in decline

The Ornua Purchase price Index dropped marginally (by 0.6%) for September, as higher priced contracts are worked out and more product moves at lower levels.

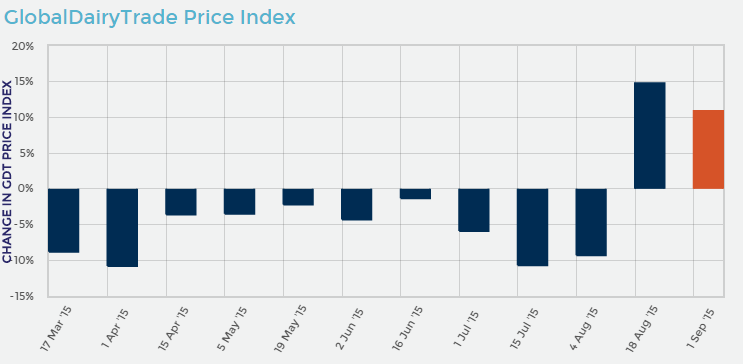

This week’s GDT auction, showing a 9.9% increase in the TWI. As a result, the average weighted price is at its highest since March, at US$2,834/tonne. The ongoing positive auction results have occurred at the same time as encouraging production forecasts coming out of New Zealand. The UK Agriculture and Horticulture Development Board (AHDB) reports that New Zealand August milk production fell to 1.34 billion litres, down 0.8% on last year. They suggest that low milk prices and producer margins have led to predictions that NZ milk production will be significantly lower this season. Fonterra, in their annual report, published last month, predict a 5% reduction in milk volumes this year. Fonterra previously expected milk production this season (Jun-May) to fall by 2-3%.

Meanwhile Radio New Zealand reports that Fonterra has decided to scrap its guaranteed milk price scheme at the end of the current season. According to reports, Fonterra said it had decided to end the scheme because it was not widely supported by farmers. It said it would call for applications for the final part of the scheme in December.

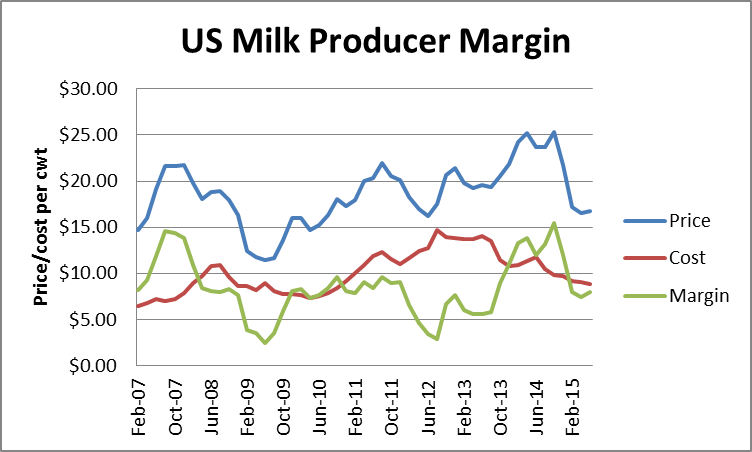

The US “All Milk” price is stable at below $17 per cwt, although the Milk-Feed margin, used as a basis for the US Margin Protection Scheme is showing margins of around $8 per cwt. This margin level would trigger supports under the Scheme (which can insure margins of up to $8) and has been reasonably consistent all year. Producer margins were much higher across last year, ranging from $12 to $15.50 per cwt. This reduced margin is probably contributing to more modest supply growth this year.