Still in the Doldrums….

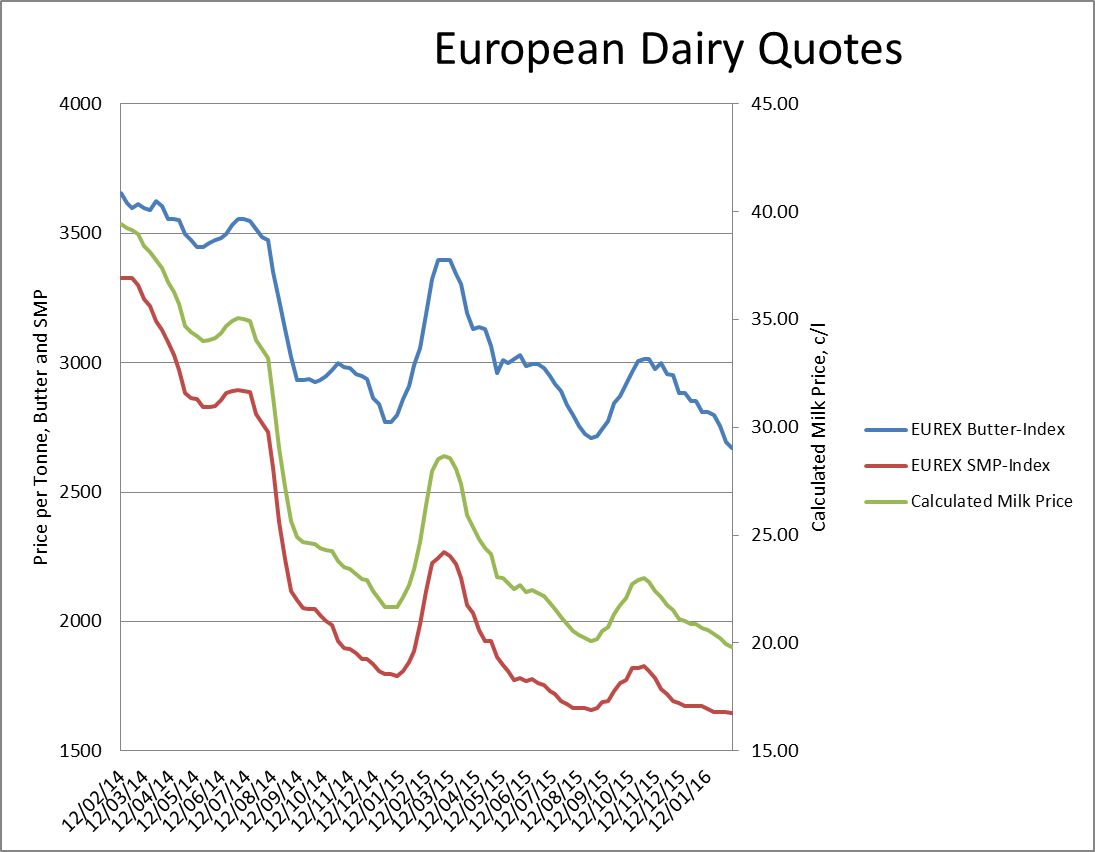

The latest EEX Exchange indices for Butter and SMP demonstrate the ongoing weakness in dairy markets. This week’s butter index value at €2670 and the corresponding SMP number of €1645 make sobering reading. Those numbers, if converted into a milk price, suggest a value of around 20c. That’s a price level not seen since 2009 and one that could be enormously damaging to farmers livelihoods. That year saw a 3% reduction in Irish milk supplies, albeit combined with terrible weather. 2009 came after a year when Irish milk processors supported milk prices to the tune of over €100 million. Arguably that was a mistake, as the support was needed more in 2009, but the Co-ops cupboards were bare. One can only hope that the global supply demand relationship comes back into balance as soon as possible because the degree to which Co-ops can continue to support milk prices from their own reserves is surely limited.

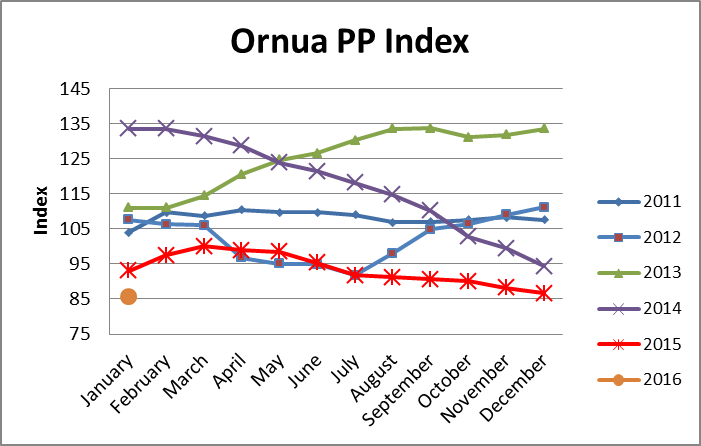

The January Ornua Purchase Price Index dropped to 85.7, suggestive of a milk return of around 25-26c. It’s a record low for the Index, which had been in place since early 2011, and the current value suggests a milk price of around 7c/litre below the average for the 5 year period.

According to the European Commission’s Milk Market Observatory, EU milk collection increased by 5.5% in November 2015 compared to the same month last year. Total milk deliveries in the first 11 months of 2015 have been 2.2% higher than in the same period in 2014. In the 11 months, SMP production rose by 8.6% while butter production was up 4.3% and SMP production was down 4.7%. The EMMO reports that EU average farm gate milk price for November 2015 was 30.8 c/kg, which is 11% lower than in November 2014 and 13% lower than the average of the last 5 years.

On the world market, the weak Euro helped the competitiveness of EU product. EU exports in the first 11 months of 2015 have increased for all dairy products except for WMP and cheese. Total exports expressed in milk equivalent would have increased by 5.2% by November. The EU has increased cheese exports to all top 10 destinations in 2015, with the US being the main outlet of EU cheese exports, up 17% on last year. Japan, at No 2 is up 50% on last year. The US, Saudi Arabia, and Egypt are the leading markets for EU butter, while Algeria is the EU’s leading SMP customer, although albeit with reduced volumes, followed by Egypt and China. Oman, Algeria and Nigeria are the main customers for EU WMP. The EMMO go on to report that Chinese imports strengthened since summer, but we still down year-on year with WMP down 49%, butter down 19% and SMP down22%. The US, Mexico and Iran have grown butter imports (+115%, +30% and +29% respectively).

New Zealand milk production decreased by 2.1% in November 2015 compared to the same month in 2014. So far in the 2015-16 season (June 2015 to May 2016), milk production was 3.1% below 2014-15 levels. Dairy Australia reports suggest that New Zealand farmers are continuing to cope with the impact of a second year of lower milk prices. With very modest retrospective payments from the 2014/15 many farmers opted to cull more cows earlier than normal. Strong beef markets made early culling an attractive short term cash flow strategy. This resulted in 5% fewer cows being milked at peak, and with below-average pasture growth expected for the balance of the season, milk production expected to remain below prior-year levels. Dairy Companies Association of New Zealand data to the end of November suggests a drop of 2.1% for the month, and 3.1% for the season to date. AgriHQ are forecasting a 3% fall in milk collections for the season to May 31, while Fonterra is reportedly expecting a 6% decrease. Fonterra’s farmgate milk price forecast is currently NZ$4.16/kg MS having been again revised downwards in early 2016 as the expected recovery in WMP prices failed to materialise. Australian milk production in November 2015 decreased by 3.4% compared to November 2014. Milk production in the US increased by 0.7% in December, a year-to-date increase of 1.2% in 2015.

Meanwhile FrieslandCampina’s “temporary measure” to stimulate member dairy farmers not to let the milk supply increase from 1 January 2016 to 11 February 2016 inclusive has come to an end. The temporary measure resulted in a reduction of the milk supply of a total of about 34 million litres of milk since January. According to the Co-operative, the measure was needed because it had insufficient processing capacity available for the period until mid-February due to a stronger growth of the milk supply than was expected. About 60 percent of the member dairy farmers participated in the arrangement. A total of 14.1 million euro was paid to the member dairy farmers participating in the arrangement (2.00 euro per 100 kg milk). The Co-op says that thanks to the temporary measure, combined with a number of other measures, it was able to buy all the milk from the member dairy farmers during the past six weeks (with the exception of the period of black ice period in the north of the Netherlands). The Co-operative says it has sufficient capacity again to collect all milk produced, because extra processing capacity has been made available within and outside FrieslandCampina. Expectations are that the processing capacity will remain tight until the summer.

By TJ Flanagan

ICOS Dairy Policy Executive