Markets Commentary

Market Commentary

Market Commentary

Markets are cautious as milk supply shows signs of recovery in New Zealand, while the USA continues to expand its output unabated. Meanwhile, major geopolitical issues such as Brexit and the new Trump administration are creating uncertainty. In Europe, there are very tentative signs of supply rising due to higher prices. SMP stocks in public intervention remain at the same level following successive tenders without product shifting. Demand for dairy fat remains strong driven by consumer demand.

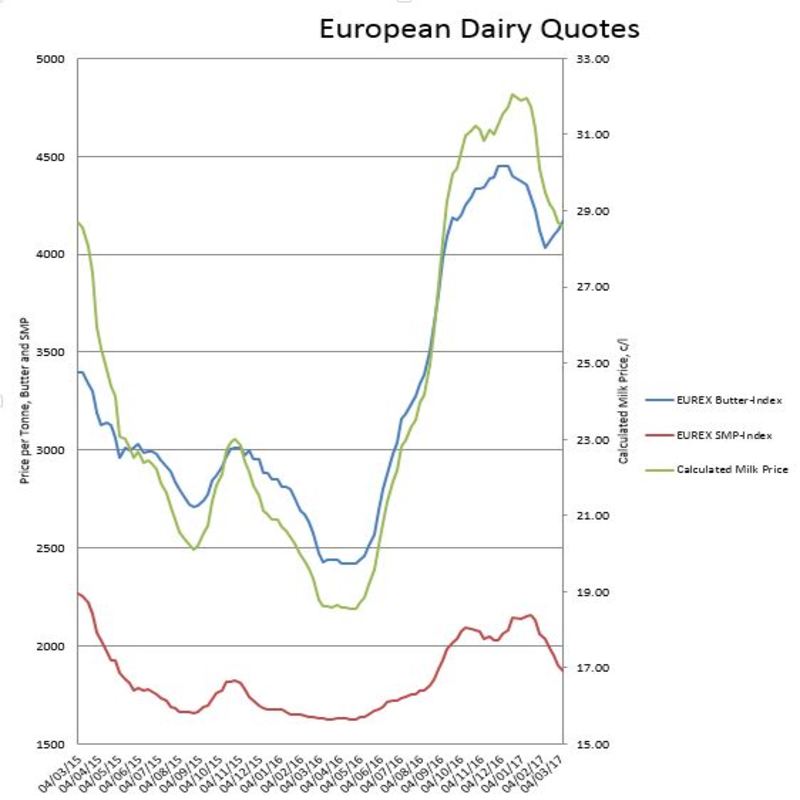

The Ornua Purchase Price Index for February is unchanged at 105.4. EU butter is the most competitive on global markets. The EUREX Butter Index is at €4175 per tonne, while the SMP Index is down to €1,867 per tonne.

Dairy Australia’s expectation is that milk production for 2016-17 will be down 6-8% on 2015-16. Originally expected to be down 7% for the season, New Zealand collections forecast has now improved to a 3-5% decline on last season. The GDT Price Index fell by 6.3% on 7th March mainly due to falls in powder prices with increased volumes of WMP and SMP being offered. Fonterra has confirmed the forecast farmgate milk price of $6.00 per kgms announced in November, combined with forecast EPS range for 2017 of 50 to 60 cents. The advance rate for February, paid in March has increased to $4.85 per kgms.

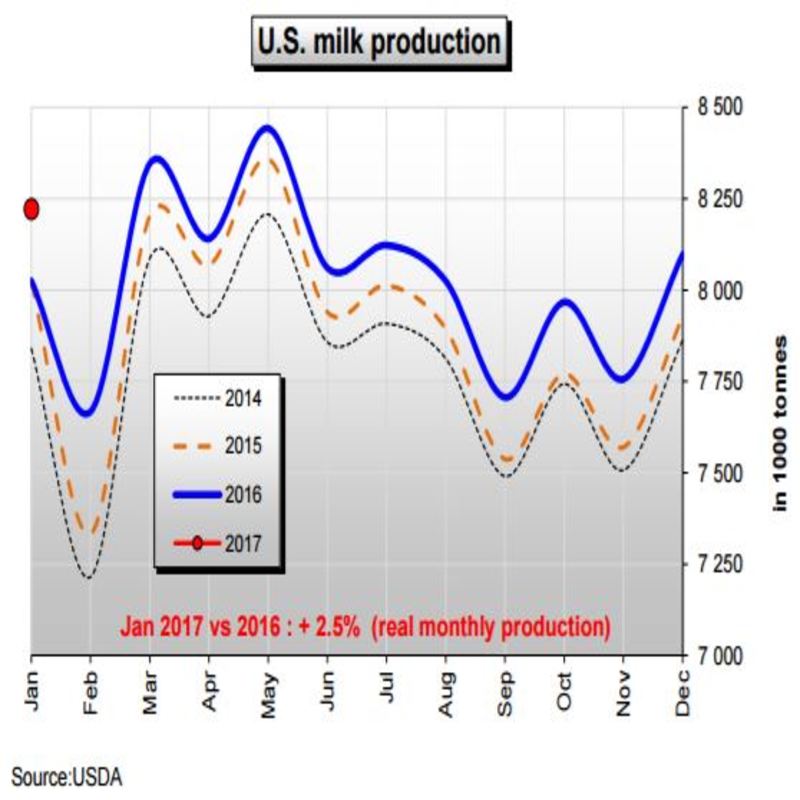

In the US, January milk output increased by 2.5%. US milk output exceeded 96 billion litres in 2016, with cow numbers at record levels. Domestic demand for dairy products remains good, with a strong US$ tempering exports.

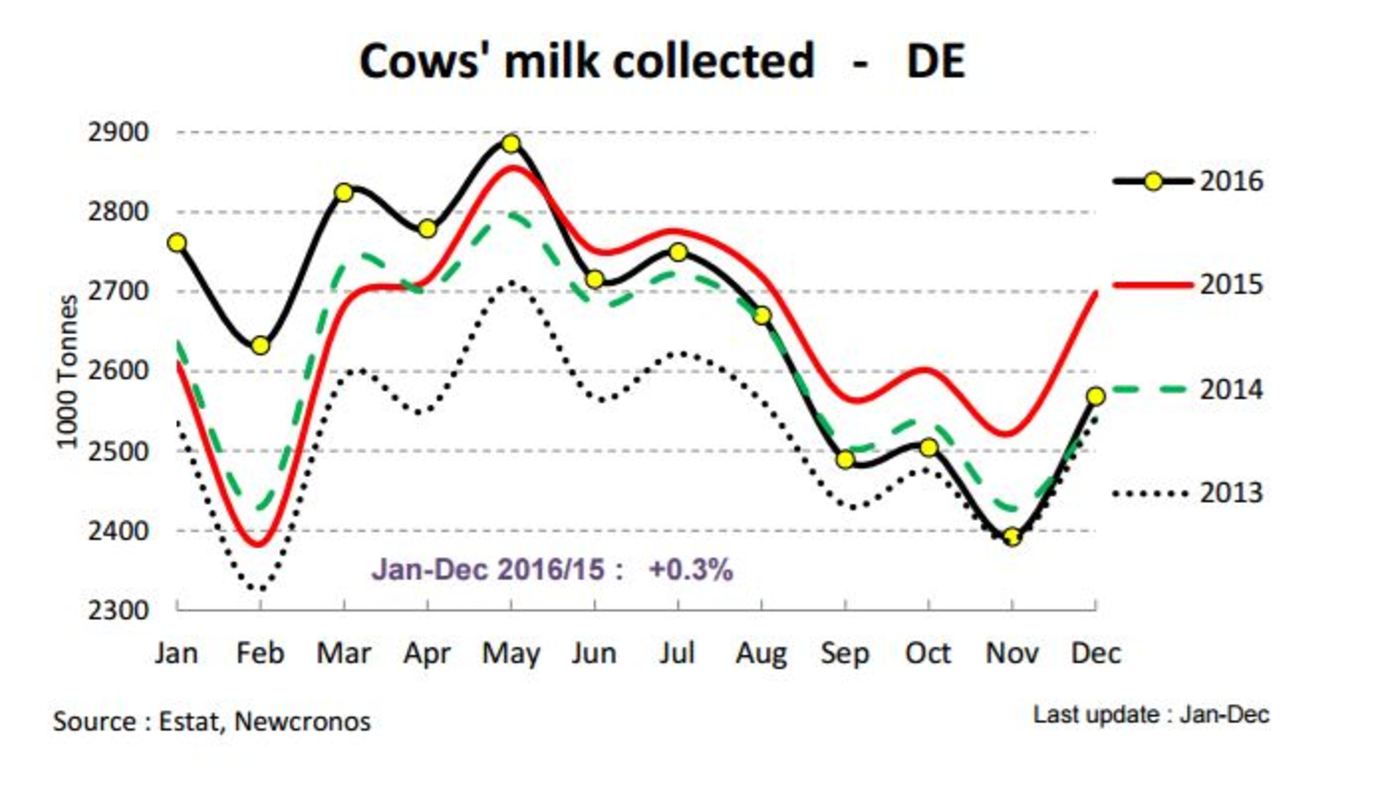

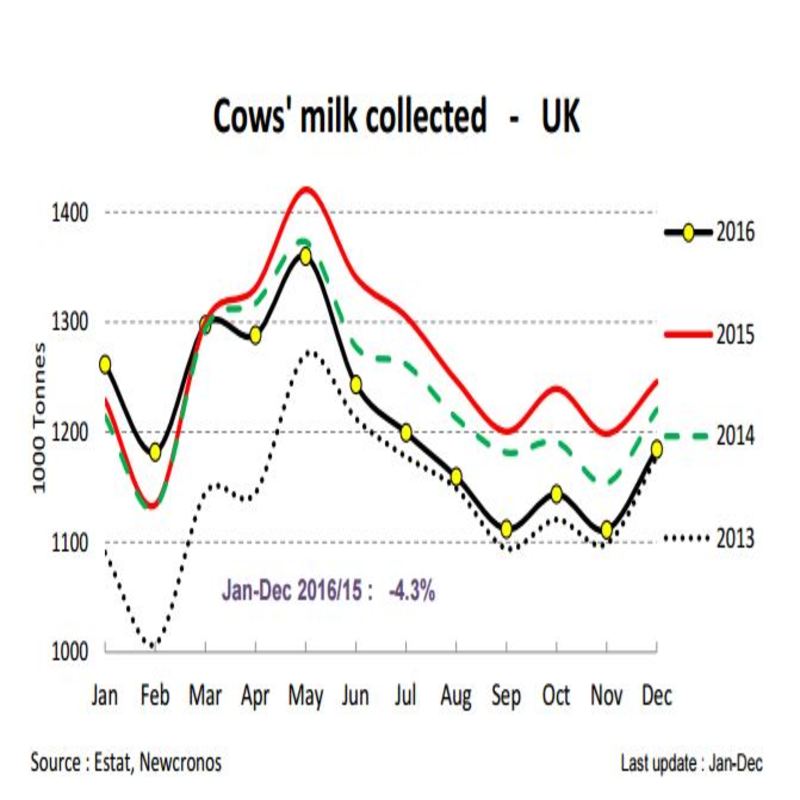

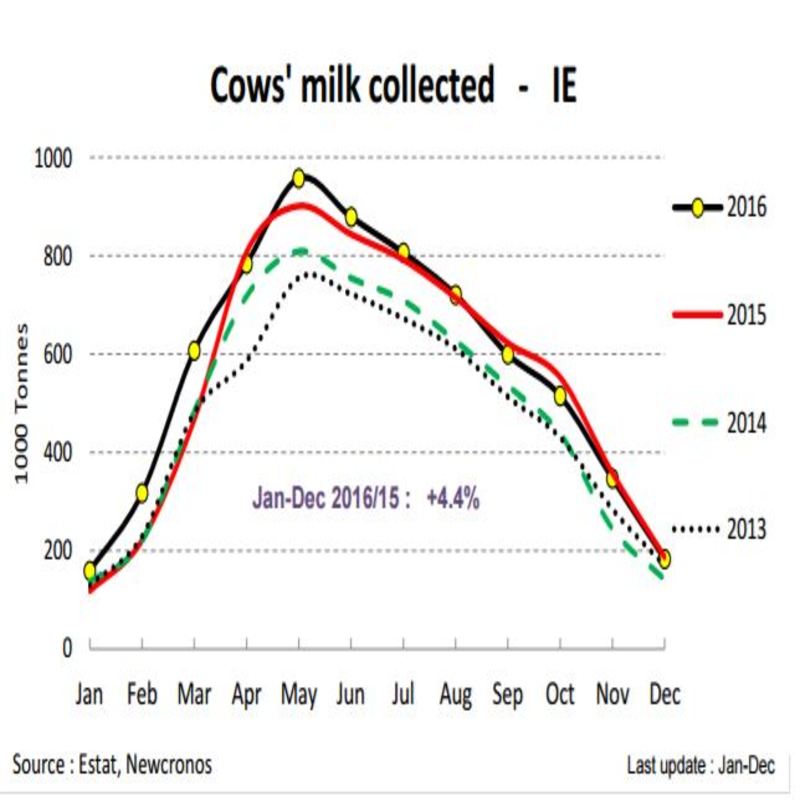

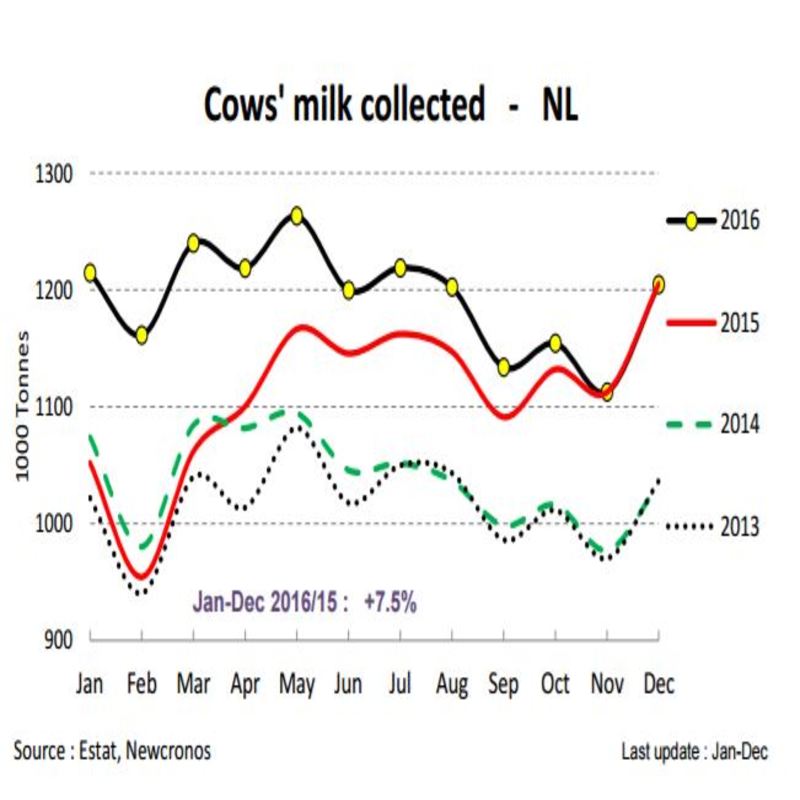

In 2016, EU milk output increased marginally by 0.4% year on year. The European Commission is forecasting similar levels of output in 2017. The EU’s biggest suppliers Germany increased by 0.3%, France decreased by -2.5% and the UK milk output fell by -4.3%. Irish milk production increased by 4.4%, while milk flows in the Netherlands increased by 7.5%.

The Netherlands is coming to terms with its obligations to control the level of phosphates from its dairy sector. The Dutch Ministry of Economic Affairs adopted a decree on 17th February enacting its phosphate reduction plan on 1st March 2017. The European Commission has approved the plan that will see a 6.6% cut in the Dutch dairy herd. In advance of March 1st deadline, Freisland Campina introduced a so called “temporary standstill measure” from 9th January to 1st March. The measure included both a premium and price deduction element. The scheme resulted in 53 million kilo less milk over this period. The measure prevented an increase in milk output in the lead up to the new phosphate regulations, while supply and available processing capacity was kept in balance. Dutch milk deliveries are expected to be back by up to 5% in 2017.

The Netherlands is coming to terms with its obligations to control the level of phosphates from its dairy sector. The Dutch Ministry of Economic Affairs adopted a decree on 17th February enacting its phosphate reduction plan on 1st March 2017. The European Commission has approved the plan that will see a 6.6% cut in the Dutch dairy herd. In advance of March 1st deadline, Freisland Campina introduced a so called “temporary standstill measure” from 9th January to 1st March. The measure included both a premium and price deduction element. The scheme resulted in 53 million kilo less milk over this period. The measure prevented an increase in milk output in the lead up to the new phosphate regulations, while supply and available processing capacity was kept in balance. Dutch milk deliveries are expected to be back by up to 5% in 2017.

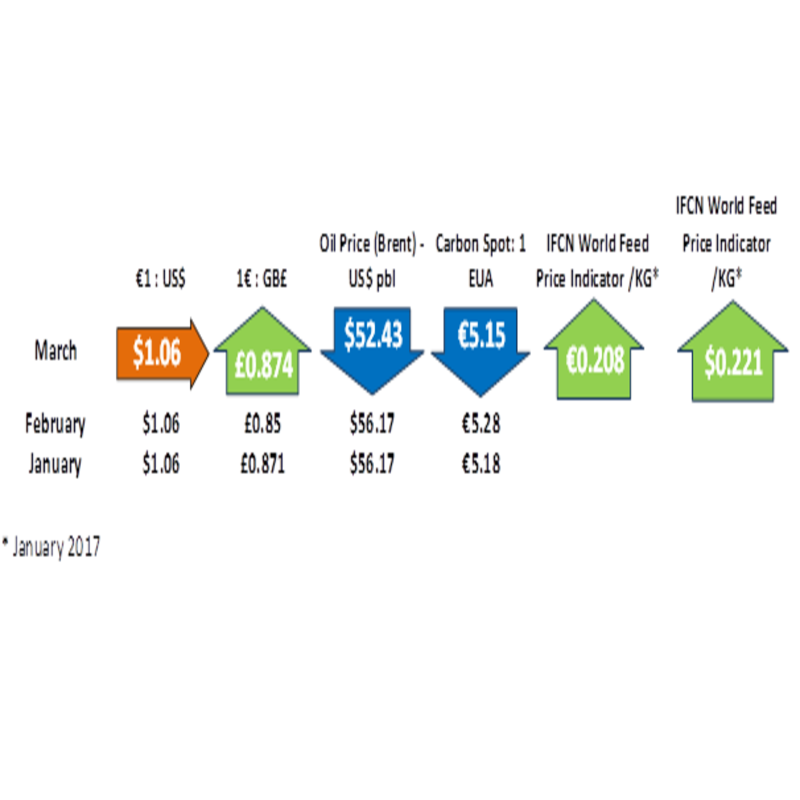

Finally, oil prices have been pushed downward to approximately $50 per barrel due to improved forecasts by US shale producers despite efforts by OPEC and non OPEC countries to tighten its supply.

By Eamonn Farrell

Agri-Food Policy Executive