Markets Commentary

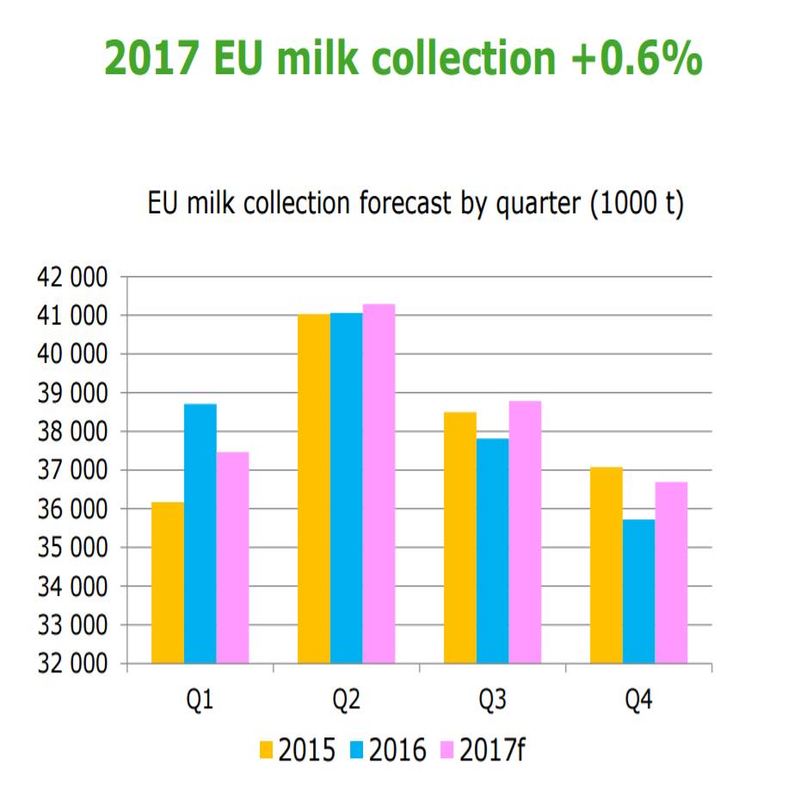

Milk flows are recovering in France, Germany and the UK. For example, weekly milk deliveries in the UK are now at the same level as last year and in Germany milk flows are above a 3 year average. It remains to be seen If the Netherlands reduction in cow numbers due to phosphates will be achieved by moving significant numbers of dairy cattle to other countries, rather than slaughter, that could alter the expected outcome. The EMMO expect EU collections to be marginally above 2016 levels, with output in Q3 and Q4 recovering ground on the first half of 2017.

In New Zealand, milk production in February was marginally below 2016 levels when adjusted for the extra day. Milk production in Australia remains challenged due to a turbulent period which has damaged profitability across its supply chain. In the US, milk flows are consistently above 2% y-o-y including February when adjusted for the leap year. US cheese exports in particular are benefiting from CWT assistance.

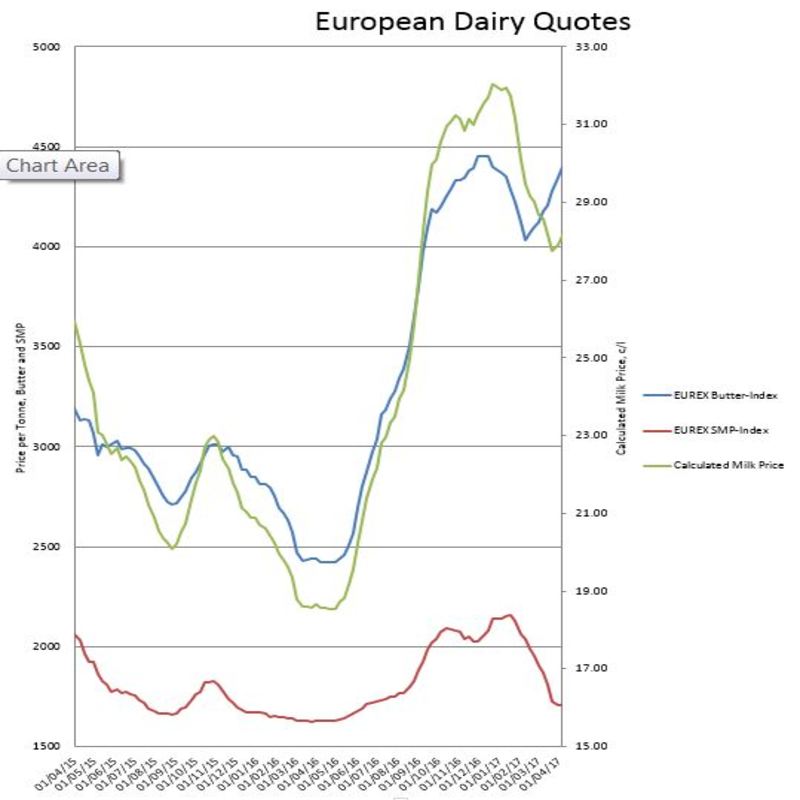

Dairy fat is strongly outperforming protein, which is supporting farm gate prices. The Eurex butter index is at €4398/tonne, with SMP barely above intervention levels at €1710/tonne. However, the SMP/Butter mix is returning less than alternatives due to the weakness in the SMP market making Cheese/Whey more attractive.

Butter and cheese prices remain strong with some resistance to higher prices from consumers. Ahead of the Spring flush, the direction of the market is uncertain for the second half of 2017.