Markets Commentary

Commodity Prices

Commodity Prices

EU milk production is down by -0.6% for the year to June. The large milk producing nations of Germany and France were down -0.35% and -1.3% respectively for monthly collections in June. Year on year increases were recorded in Ireland (+9.5% in July), Italy (+5.7% in June), Poland (+6.6% in July) and the UK (+1.8% in July). Meanwhile, the Netherlands posted a decline of -2% in July.

Market observers believe that current high prices for butter and strength in cheese markets may lead to more milk production in coming months. Overall, the European Commission is forecasting that 2017 deliveries will be up +0.7%. This will translate to a +2% increase in H2. Butter quotations remain at unsustainable levels with market resistance evident to higher prices. The Butter EEX index is at €6,892 per tonne with the SMP index at €1,677 per tonne. Since August, 2,107 tonnes of skimmed milk powder has entered public intervention, which will close on 30th September.

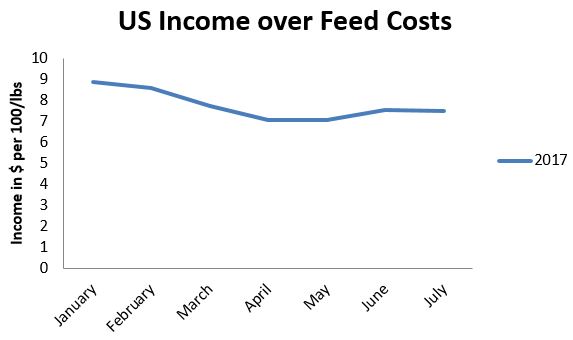

Globally, milk output increased marginally in H1 by +0.4%. While volumes are low, early pointers are indicating a strong start to the new season in Oceania. US milk production was up +1.8% in July. An equivalent of 15% of US milk production is exported. The US Dairy Export Council has announced an ambitious plan to grow that number to 20% by 2021.

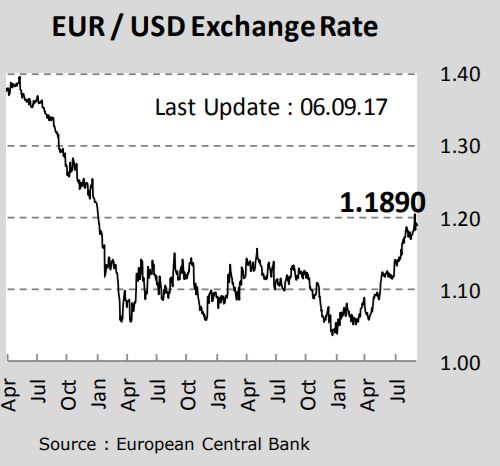

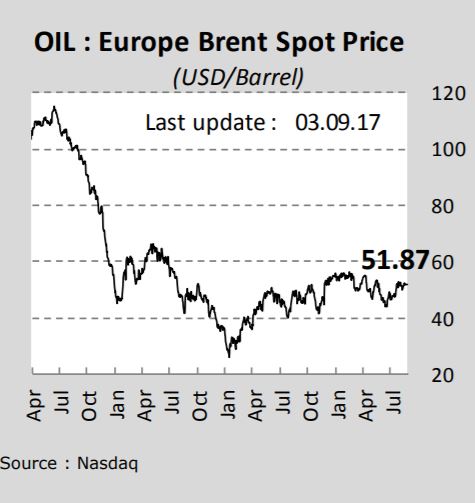

Speaking at the ASA Conference on 8th September, Jim Bergin noted that the weaker US$ will be one of the biggest factors to influence markets in 2018. The US has in excess of 600,000 tonnes of cheese, 134,000 tonnes of SMP and 139,000 tonnes of Butter in stockpiles. Another key market indicator is the price of oil, with prices stabilising at the $50/barrel mark. A stronger oil price is needed to stimulate demand in oil producing nations.

By Eamonn Farrell

Agri Food Policy Executive