Markets Commentary

The 19th IFCN Dairy Conference was held in Teagasc Moorepark from 11th-13th June. ICOS was pleased to support the event with dairy industry experts attending from over 40 countries.

Trade in early 2018 has been driven by China in January (+35%) with a following slow-down in imports over February and March. In addition, Japan, Algeria and Saudi Arabia have all contributed to firm demand in world imports so far in 2018.

Margins were reported as being tighter on US dairy farms (growth at +0.6% in April) with labour availability impacted by the polices being pursued by the Trump administration. Canada’s impact on world dairy markets was noted with interest with milk production in Canada at +6.8% in 2017 compared to 2016. With the prospect of a global trade war increasing day by day, the US President took to twitter recently to vent his fury at Canada’s dairy sector policies.

Dr Torsten Hemme, Managing Director of the IFCN, outlined a positive perspective concerning dairy demand out to 2030. He stated “More milk will be needed on the market. The increase of demand is not only due to more people living in the world, but also the per capita consumption will increase, due to growing prosperity and worldwide investments in dairy product development”.

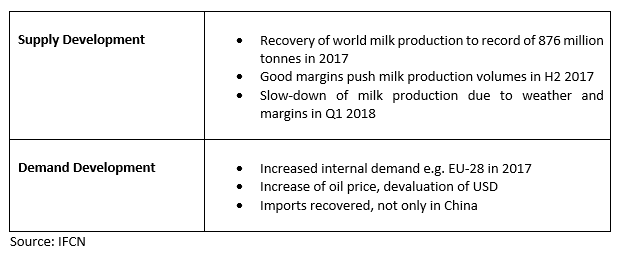

A summary of the drivers of price stabilisation in 2017/18 are outlined below.

Drivers of Price Stabilisation in 2017/18

The Ornua PPI in May is 105.4, up from 100.4 in April which reflects stronger returns in the month for butter and powders. The EEX Butter index is trading at €6,170 / tonne, with the EEX SMP index at €1,590 / tonne. The lifting of SMP prices from the floor and butter trading at elevated levels means the Butter/SMP combination is returning increased value. The European Commission in mid-May released 42,000 tonnes of intervention stock at between €1,155/t and €1,277/t. The June tender results will be known this week.

Eamonn Farrell

Agri Food Policy Executive