Markets Commentary

The level of milk supply across the main regions will be the key determinant of future pricing over the coming months. Output in New Zealand is up in July (+5.6% y-o-y). In addition, collections are recovering in Argentina +4.1% in July y-o-y. While, output in Australia is impacted by hot weather (-4.2% y-o-y). Supplies are constrained in the US (+0.4% y-o-y) in July with lower prices impacting. Cumulated EU supplies from January to July are up 1.7% y-o-y, with milk collection +1.1% in July y-o-y. German and French output is up in July y-o-y at +2.7% and +1.2% respectively. 13 Member States including Ireland experienced a fall in output in July, mainly due to weather related factors. UK weekly deliveries are in line with 2017, with Dutch deliveries -1.2% in July and -2.9% in August.

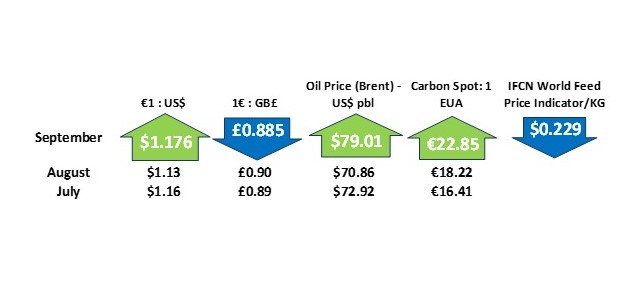

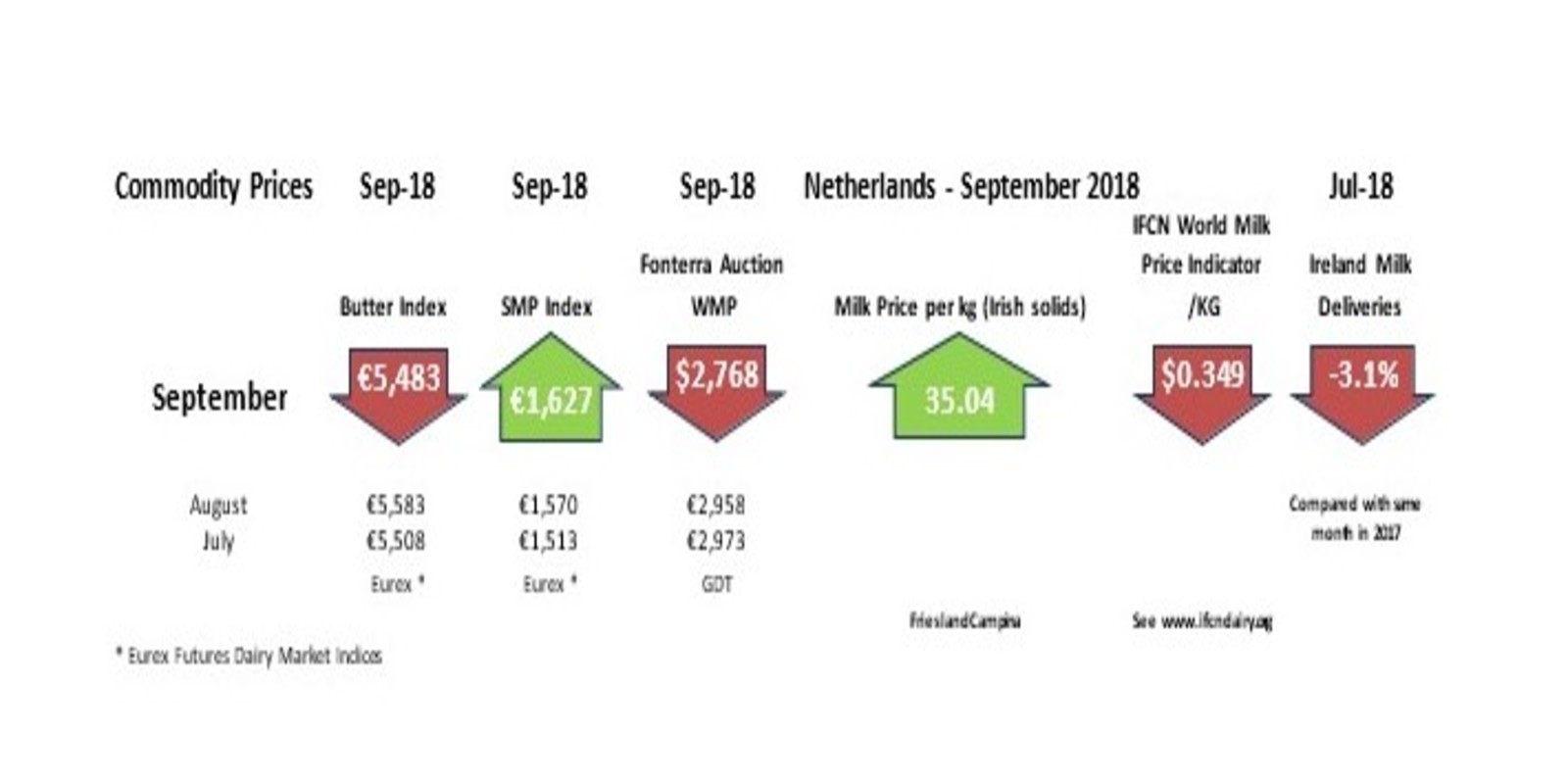

Butter is trading at €5,483/t on the EEX Index with future prices expected to vary between the €4,500/t and €5,000/t. Cheese remains solid with demand supported from the food service sector. WMP prices slipped at the most recent GDT auction, in part, due to increased supplies. The SMP market remains volatile, despite intervention stocks failing to 255,000 tonnes. SMP on the EEX Index is creeping up to the historic intervention price at €1,627/t as pricing for fresh product diverges. The impact of trade wars remains a major concern, affecting future demand.

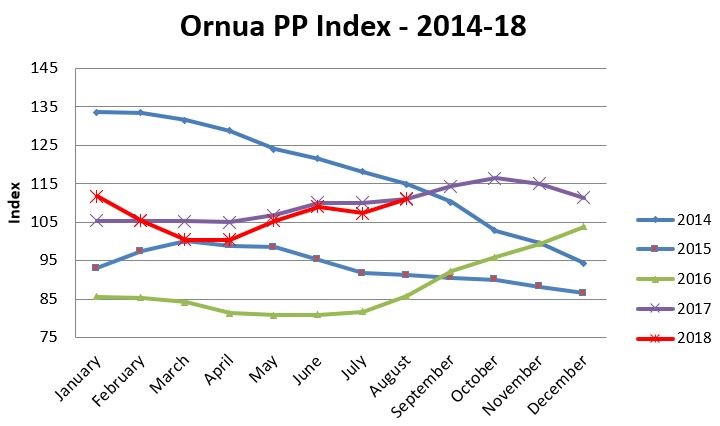

The Ornua PPI is 111.0 in August, reflecting stronger returns for butter and milk powders.