Markets Commentary

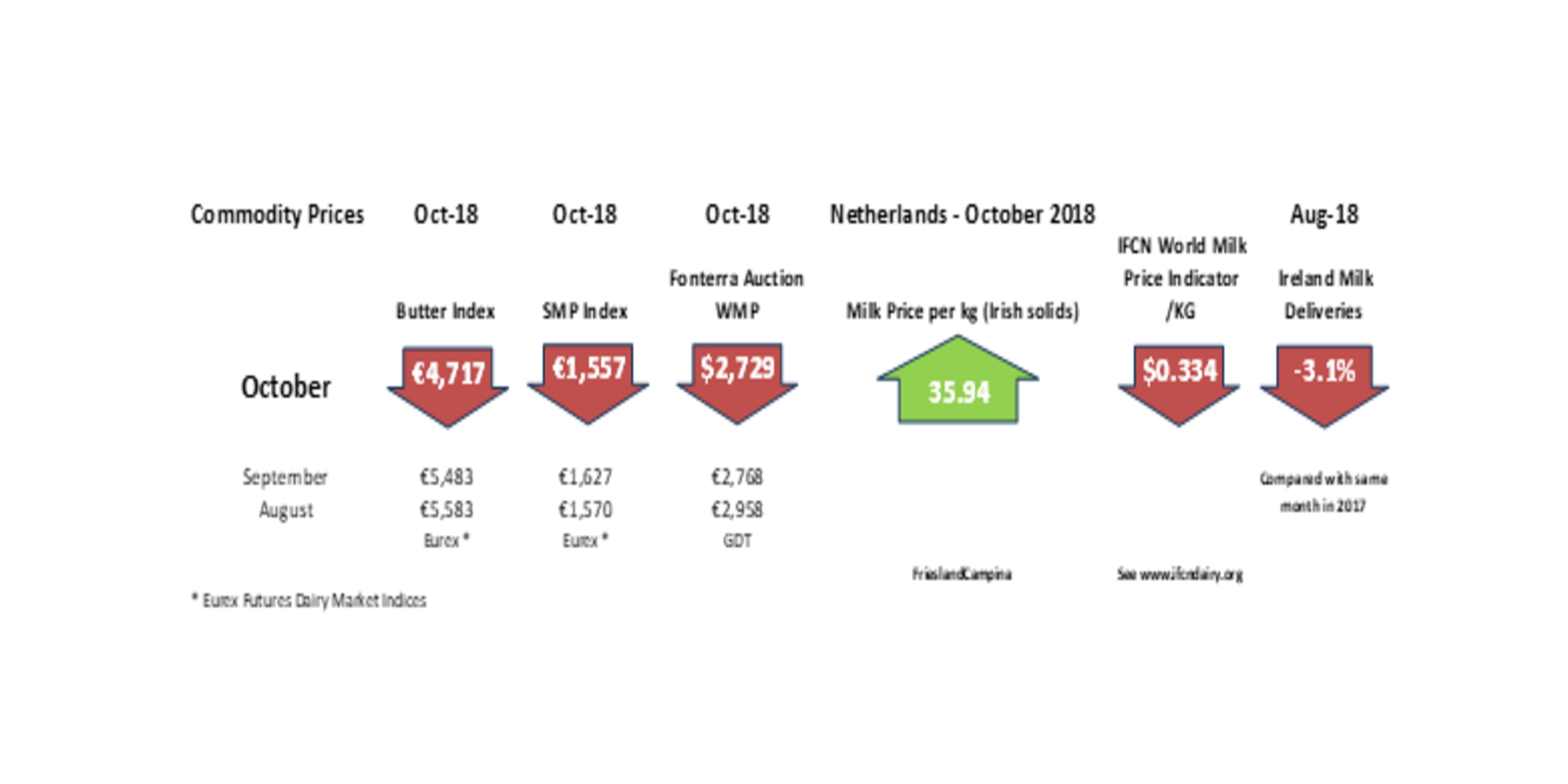

A further 26,000 tonnes of SMP was sold from intervention last week at prices between €1231/t and €1300/t. The total amount of intervention stock is now under 250,000 tonnes. EU Ministers of Agriculture have adopted a Commission proposal to extend into 2019 the zero ceiling for intervention introduced in 2018. The EEX Index for SMP is trading at €1557 / tonne indicating that while prices for fresh product have improved, they remain under the historical intervention price.

Butter prices have become more volatile in recent weeks. Butter is trading at €4717/t on the EEX Index, with prices down over €1000/t compared to July. Returns from butter/casein remain more favourable than Butter/SMP. Cheese prices remain solid with UK imports expected to increase in Q4 and Q1, as part of Brexit contingency planning. Asia accounts for one half of global cheese imports, with imports expected to increase by 1.8% in 2018 due to rising incomes and changing food habits in Asia.

New Zealand is reaching its peak supply currently, with favourable conditions leading to stronger milk flows and weaker price forecasts. The global economy remains strong but weaker economic reports from China and uncertainty arising from Brexit and trade wars are a considerable concern.

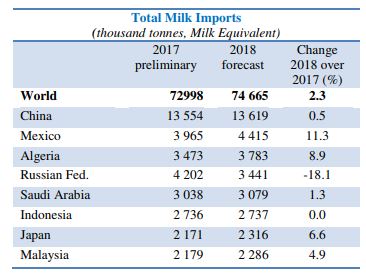

Finally, below are FAO estimates for global milk imports and exports in 2018 compared to 2017.