Markets Commentary

At the Copa-Cogeca Working Party on Milk and Dairy Products held earlier this week, several farming and co-operative bodies reported that dry weather has curtailed milk supply across Europe including France, Germany and the UK.

French milk flows were -2% in September and estimates suggest that milk collections will fall again in October and November. UK milk flows are on a par with last year, with UK figures holding up due to Northern Ireland output at +2.6% year to date. German collections have slowed in September but are up +2.6% year to date. Overall, EU milk collections are up +1.5% year to date with production flat in August and September. Globally, New Zealand milk collections are strong (+6% in September) through their peak season due to favourable weather and US collections continue to expand (+1.3% in September). Milk flows in Argentina are also rebounding, up +6% year to date.

EU production year to date for butter (+1.8%) and cheese (+1.8%) is up, while less WMP (-2.7%) and SMP (-0.4%) was produced.

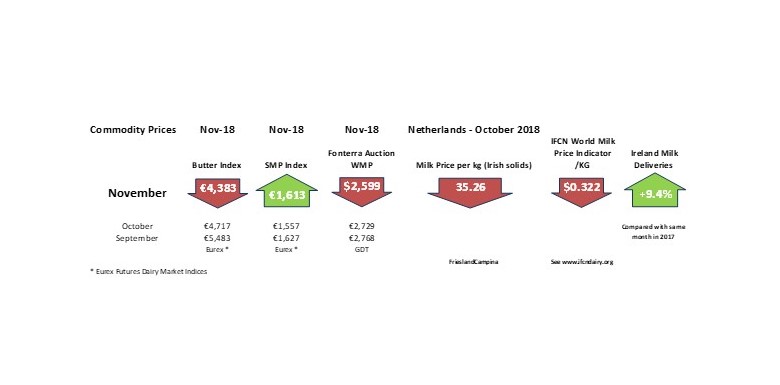

Butter is now trading at €4,383/tonne on the EEX Index, with Irish output recovering in recent months. EU exports of butter is down -13% year to date with less demand from Saudi Arabia and China. Additionally, retail demand in Germany has been affected by higher prices. The US remains the EU’s largest export market for butter with Ireland accounting for 83% of total EU exports to the USA.

Demand for cheese remains solid, but stock levels are building. Despite high oil prices, which traditionally support powder demand, the WMP market remains sluggish with FFMP growing in demand. A further 30,000 tonnes of SMP was released from intervention, reducing total stock levels to 215,000 tonnes. Pricing for freshly produced SMP is edging upwards, trading at €1,613/tonne on the EEX Index, but this is still below the intervention price thresholds.

By Eamonn Farrell

Agri Food Policy Executive