Markets Commentary

Global milk supply fell -0.3% in November and was flat in December, due to weaker EU collections (-0.9% in Nov and Dec) with more moderate US supplies (+0.6% in Nov and +1% in Dec) and strong NZ supplies recorded at (+5% in Dec & +7% in Jan).

Australian supplies are back -7% in Nov and Dec due to extreme heat. Output from Argentina fell – 0.9% in Nov and -2.1% in Dec with EI Nino impacting.

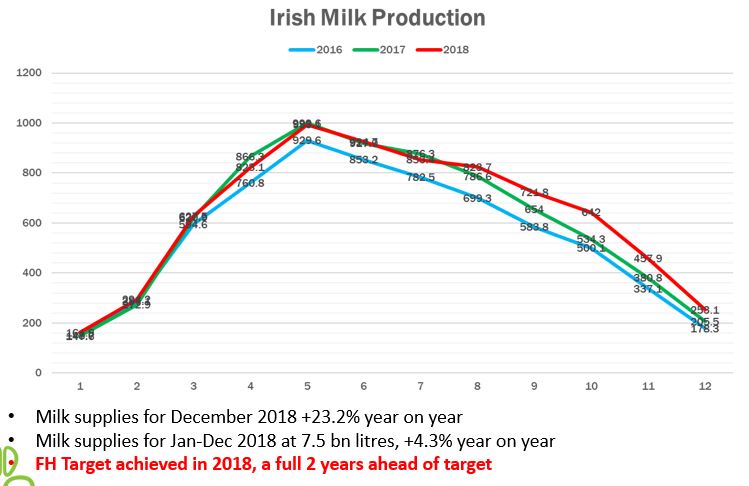

In Europe, weaker output from France, Germany and the Netherlands are offset by increased milk flows from Ireland, the UK, Poland and Denmark.

Weather wise, extreme weather events in the US and Australia will impact supply but milder winter weather experienced across Europe. The EU average farm gate milk prices decreased by 1.4% in Dec 2018 to 35.6 c/kg, 5.1% lower than a year earlier.

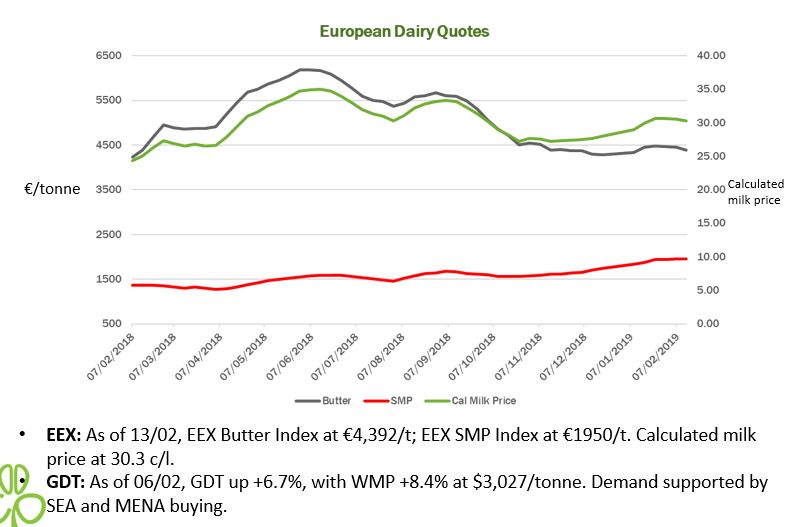

European SMP intervention stocks are now reduced to a mere 3,000 tonnes. On February 7th, the CMO Committee accepted bids worth €162.20/100kg resulting in smaller volumes being released (584t), compared to recent tenders where significant volumes were released.

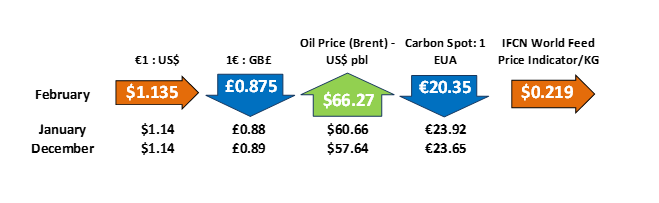

The UK economy is slowing due to the impact of Brexit uncertainty, meanwhile the EU economy is also experiencing a slowdown. The US economy remains strong but trade tensions persist with China, which is a big concern. Brent increased to over €60/barrel, while the EUR is stable vs USD and weaker vs STG.