Market Commentary

ICOS attended the Economic Board Meeting of the European Milk Market Observatory on the 29th of March 2019. The European Commission reported that EU milk flows in January were -1.5% year on year.

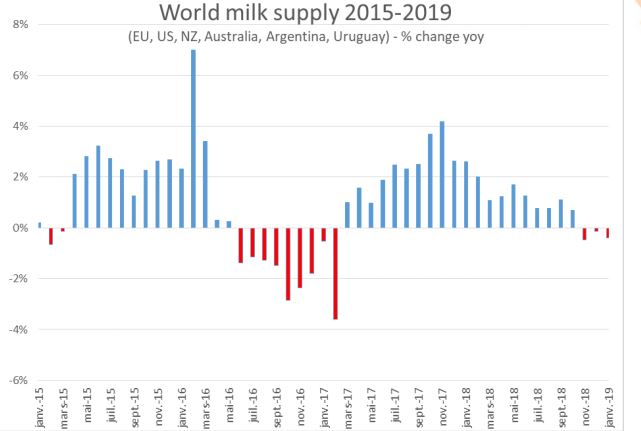

However, EU milk flows were above corresponding levels in ’15, ’16 and ’17. Milk production in Europe is strongest in Ireland, the UK and Poland. In February, milk flows in France were -2.7% year on year, with Germany also behind 2018 levels in February, but Germany now reporting that weekly flows are on a par with last year. In New Zealand, dry and hot weather since the turn of the year is now affecting output with growth for the season estimated at +2%, down from +4%. Output in Australia and Argentina remains weak, with US output still growing but at a slower rate. Overall, global flows are expected to grow modestly in H1, by 0.5%.

Dairy industry and trade representatives at the EMMO meeting expressed concern that some buyers were not taking medium term decisions due to continued Brexit uncertainty, the political situation in Algeria is also a concern, as well as trade issues globally. It was reported that SMP stocks in the food chain are high. Fat and protein prices are moving closer together. EU SMP market sentiment has improved due to depletion of intervention stocks and strong EU exports driven by low prices. There is good underlying demand with cheese, which means the market should remain in balance, but increased availability and stocks will put prices under pressure. Competition on the global market remains strong. EU butter prices have eased and European butter is now more competitive on the world market. The lower prices should stimulate export demand.