Market Commentary

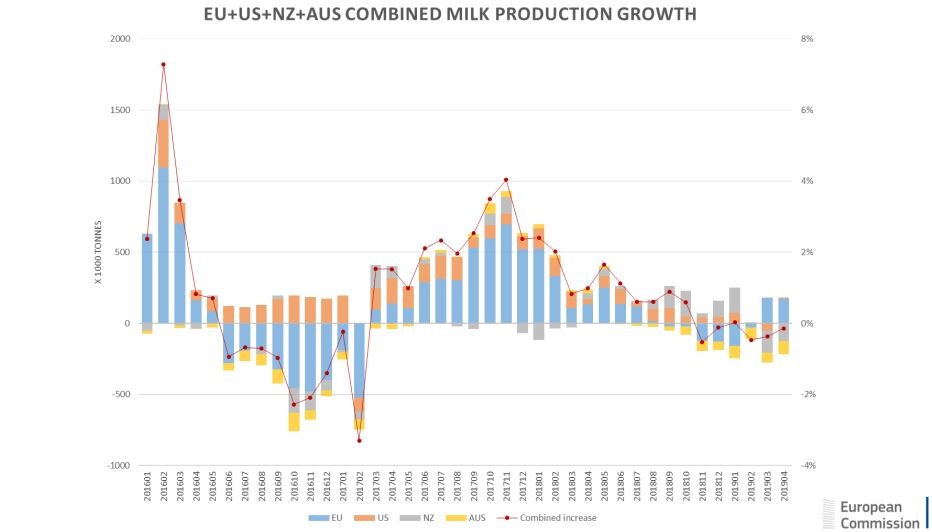

Global milk supply in May fell marginally (-0.3% year on year), with output weaker in Oceania with New Zealand’s season coming to a close (-0.1% in May year on year and +2.3% in 2018/19), the US (-0.4% in May year on year) and South America (Argentina -6.3% ytd and Uruguay -9.1% ytd).

EU output is marginally up in May (+0.4% year on year) supported by strong output growth in Ireland, Poland and the UK. Milk collections in Germany (-0.8% in week 24), France (+0.3% in week 24) and the Netherlands due to phosphate restrictions remain sluggish. Global supply is expected to be more robust in H2 2019.

Trend in Global Milk Supply:

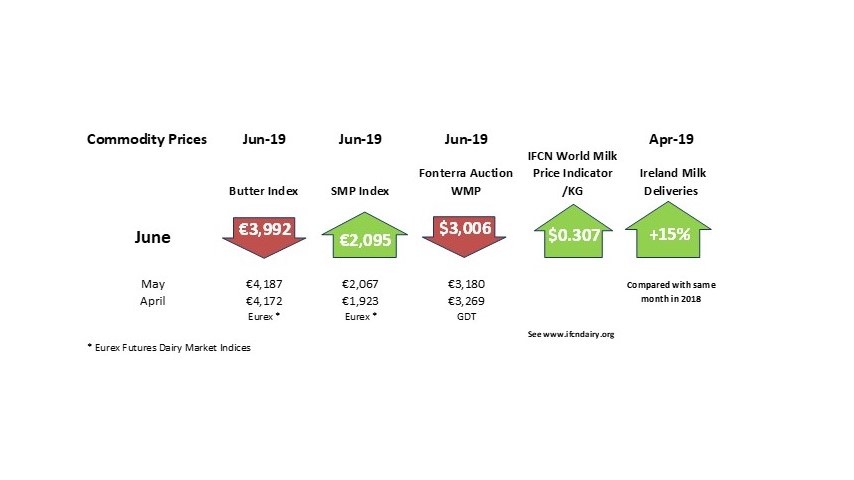

Demand in H1 was driven by China and Asia but the outlook for H2 is uncertain. The Euro has strengthened against the US$, which is detrimental to export performance and Sterling continues to weaken, as the prospect of a No deal Brexit looms large. ASF in the Chinese and Vietnamese pig herds will have both positive and negative impacts on dairy markets. EU cheese prices are reported as being stable to weak. The downward pressure on butter prices continues with stocks above normal levels. The EEX Butter Index is at €3,693/tonne, although prices are reported as being even lower. The EEX Index for Butter is nearly €2,000/tonne lower than 12 months ago. The EEX SMP index is at €2,088/tonne with exports performing well.