Market Commentary

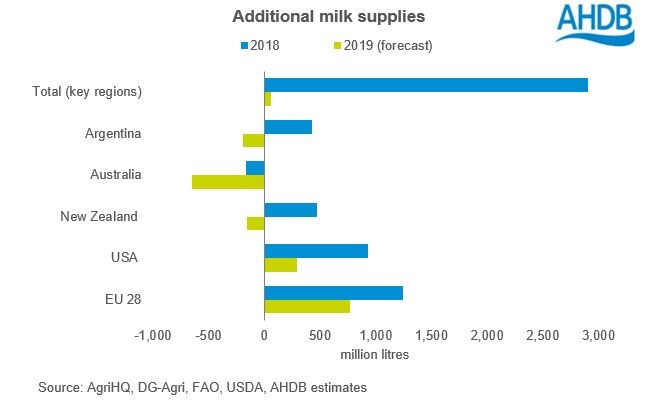

There will be no growth or extremely modest growth at best in global milk output in 2019. Weaker milk flows are predicted than initially forecasted. For example, US output is flat year to date, compared to a typical annual growth rate of 1% to 1.5%.

Reasons include the impact of trade wars, a squeeze in margins and a decline in cow numbers (despite yield to cow improvements). Milk production continues to suffer in Australia, while total deliveries in Argentina are behind last year but improving. Overall, sluggish global supplies will be offset by higher EU and modest flows from New Zealand. Fonterra increased its 2019/20 forecast farmgate milk price to a midpoint of $7.05 per kg/MS due to firm demand for powders.

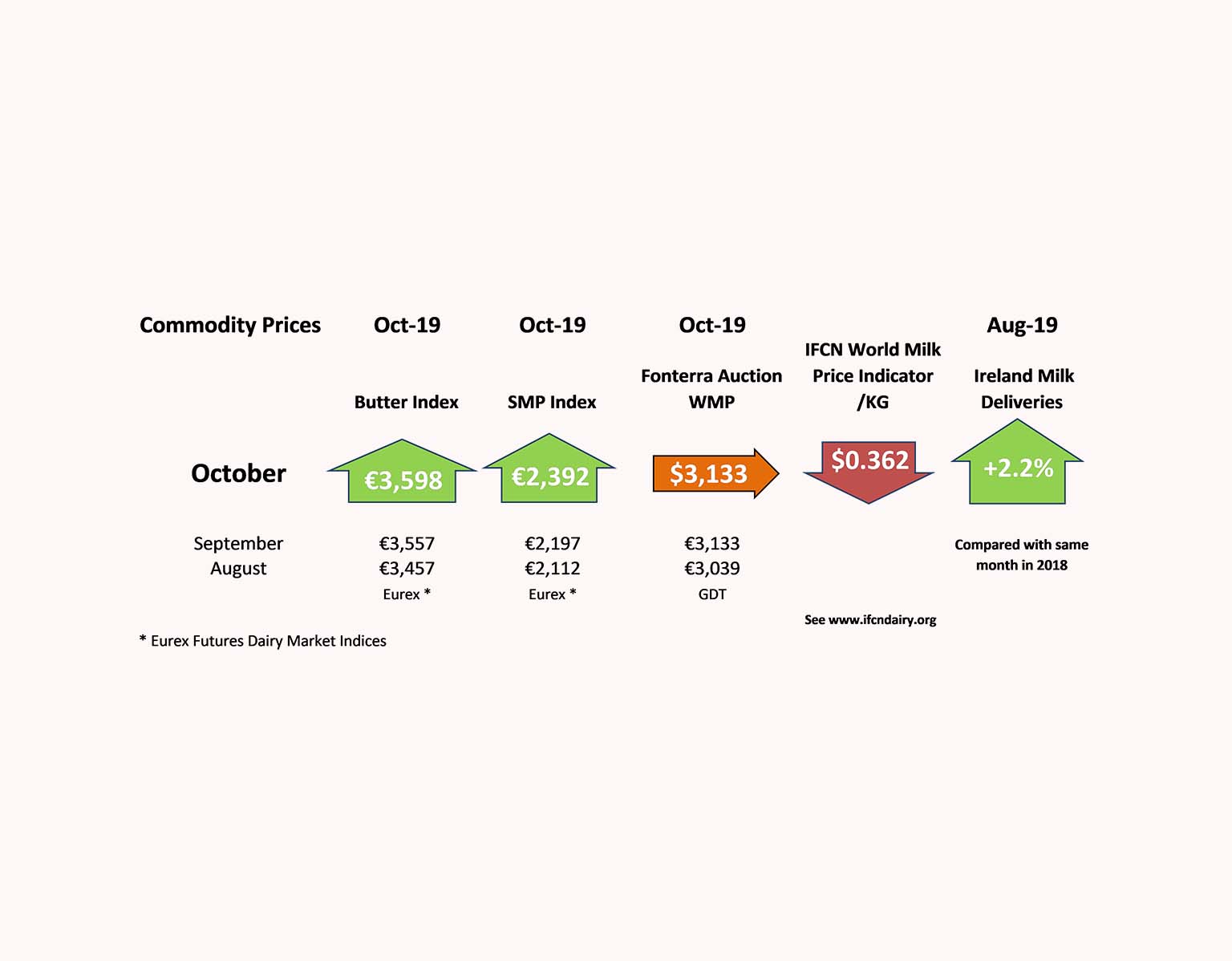

We are now in the busy buying and trading period. The Dutch quotation for butter is at €3,520/tonne, while the price on the physical market is trading at approximately €3,400/tonne. Butter returns have now stabilised with lower prices resulting in improved retail demand. The SMP market is stable, with the SMP EEX Index trading at €2,392/tonne. Exports are performing well.

Brexit uncertainty is set to continue as an Election in the UK appears to be a real possibility. The US and EU trade war over aerospace subsidies will negatively impact EU cheese and butter exports, with the estimated cost for Irish dairy at €41 million. In China, African Swine Fever may create opportunities for dairy due to a growing protein deficit.

By Eamonn Farrell – Agri-Food Policy Executive