Market Commentary

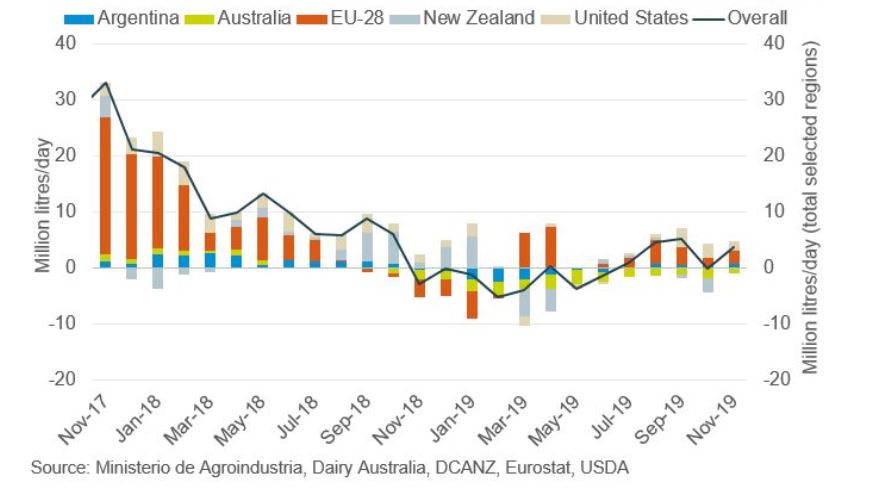

Milk supply growth across the main exporting regions remains modest with milk solids growing at a faster rate than supply.

The global export trade for cheese and butter is robust but domestic consumption in the EU is more sluggish. Demand was supported by seasonal buying and strong powder demand from Asia. The EEX Butter Index is at €3,623/t, with the Dutch quotation at €3,570/t. The SMP EEX Index is at €2,637/t. The decline in butter prices and recovery in SMP prices has turned the market on its head. Strong SMP prices is likely to result in increased butter output.

Bord Bia has reported that Irish dairy exports were valued at €4.5 billion in 2019, with butter (€1.2 billion), cheese (€998 million) and SMP (€332 million). Irish dairy products were exported to 124 countries with the UK, the Netherlands (mainly further processing and re-export), China, the USA and Germany our top markets. Despite a downward pressure on prices, butter exceeded the €billion mark for the second consecutive year with US exports particularly strong. The UK accounted for 45% of Irish cheese exports in 2019. Bord Bia has identified Japan as a key market for future growth. Cheese exports to the US also increased but the introduction of US tariffs will impact. SMP exports in value terms doubled in 2019 helped by very strong Asian market demand.

Over the longer term, the European Commission predicts that over the next decade, sustainability factors will lead to a more moderate increase in milk production across the EU, reaching 179 million tonnes in 2030 (compared to 168 million tonnes in 2019). It forecasts further improvements in yields, alongside an overall reduction in the herd size (expected by 1.4 million cows), enabling a reduction in GHG emissions. A large share of EU milk production growth is expected to go towards more cheese processing (24%) due to sustained global demand and increasing domestic industrial use. Cheese production is expected to grow from 10.8 million tonnes in 2019 to 11.5 million tonnes in 2030. Fresh milk consumption in the EU is projected to decline in the medium term, while EU demand for butter could continue to rise. In response to this demand, EU butter production is projected to increase from 2.5 million tonnes to 2.7 million tonnes over the next decade.

Eamonn Farrell – Agri Food Policy Executive