Markets Commentary

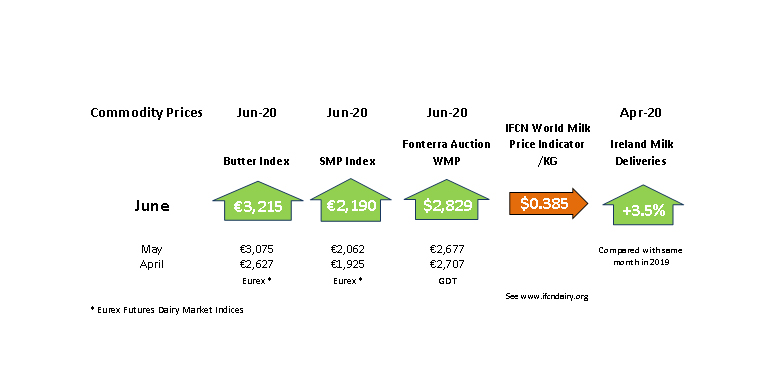

Dairy markets have thankfully stabilised with a welcome recovery and stability in butter and skim milk powder prices over the last month. Real uncertainty remains regarding the short to medium-term outlook, as fragile economies emerge from Covid-19 enforced lockdowns.

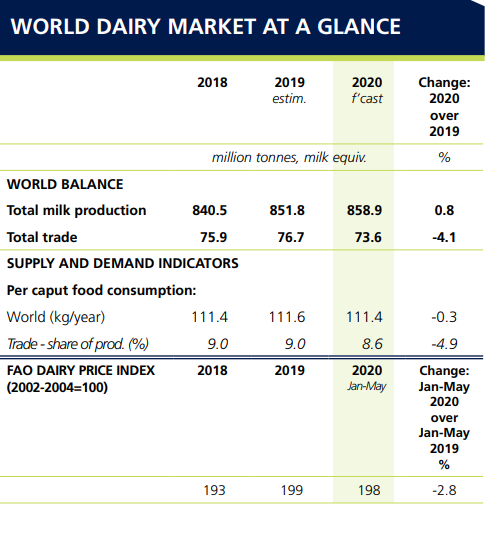

The UN Food and Agriculture Organisation (FAO) has reported that notwithstanding the disruption caused by COVID-19, world dairy markets have shown significant resilience. That said, the FAO are forecasting that world exports of dairy products will contract by 4% to 74 million tonnes (in milk equivalent), which, if confirmed, would mark the sharpest year-on-year decline in three decades.

The US dairy industry has claimed its sector was “economically harmed” by the EU intervention programme in 2016-19. The report by the NMPF, US Dairy Export Council and IDFA estimates that the EU spent €190 million on its intervention buying, storage and disposal during the period. The EU released 379,000 tonnes of SMP onto the market between January 2018 to June 2019 at an average price of €1,337/tonne. The report states that EU intervention helped the market in 2016 but in 2018-19 as stock was released, it adversely impacted US farmgate milk price, global SMP prices and enabled the EU to increase its share of the global SMP market.

Current EU market supports have helped to stabilise markets. Up to the 21st June, 13,202 tonnes of SMP received private storage aid, with 6,006 tonnes from Germany and 3,535 tonnes from the Netherlands. There is a greater uptake of butter with 54,978 tonnes receiving PSA, with 19,145 tonnes from the Netherlands, 11,754 tonnes from Germany and 11,709 tonnes from Ireland receiving storage aid. Six countries have fully used their cheese quota including Ireland, with 44% of the total cheese allocation used to date, with volumes of cheese taking up PSA now slowing. The PSA schemes for SMP, cheese and butter will close on 30th June.