Market Commentary

Supply fundamentals are positive with demand flat to weak.

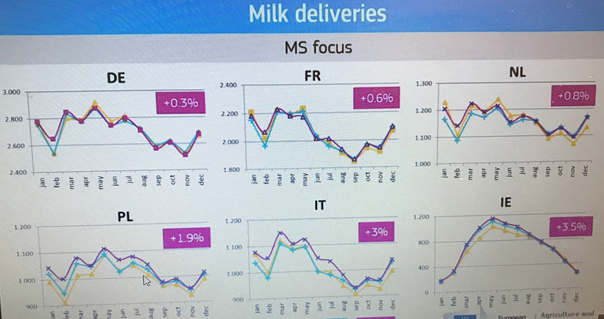

EU-27 milk production was up 2.1% year-on-year in July, with the highest increases in France (+2.7%), Italy (+4.5%), Ireland (+4.4%) and Poland (+2.2%). Dry weather in parts of Europe during August and September including Germany and the Netherlands may temper supply in Q3 but overall conditions remain positive. UK output is slightly down year on year.

Representing over 70% of EU output, the European Commission has estimated that 2020 will see positive annual supply growth in Germany (+0.3%), France (+0.6%), the Netherlands (+0.8%), Poland (+1.9%), Italy (+3%) and Ireland (+3.5%). EU milk production in Jan-July 2020 was up 2.0%, with cheese manufacture up 2.0%, butter production up 1.6%, SMP up 1.9% and drinking milk up 3.7%. For July, US production was up 1.5% and is up 1.8% in August. NZ production was up 4.4% from last July. The 2020/21 outlook in Oceania is for NZ output to increase by +2% and Australian output is forecast at +4% (although continued decline in the longer run is predicted). Argentina’s milk supply is also on the rise.

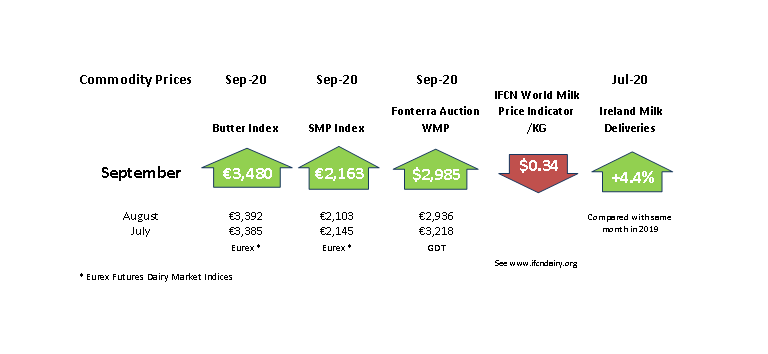

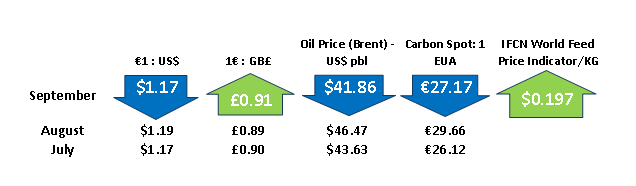

Product prices are stable, despite the gloomy macroeconomic outlook. In addition to COVID-19, exchange rate volatility and Brexit developments will be key.

At the EMMO Economic Board Meeting held on the 25th of September, Eucolait, the association of European dairy trade warned of the perils of forecasting the dairy market outlook during this challenging point of time. The dairy market has been resilient to COVID-19 but it is a fragile balance accompanied by total uncertainty, according to Eucolait. The future outlook will depend on the evolution of the pandemic and related restrictions in the next 6-12 months, government measures and polices, the availability and effectiveness of a vaccine and the severity of the recession and its impact on dairy consumption. COVID-19 is clear market fundamental.

By Eamonn Farrell – Agri-Food Policy Executive