Markets Commentary

Retail demand remains strong due to increased Covid-19 lockdown measures, following the Christmas holidays. The rollout of the global vaccine programme is key to the recovery in the foodservice segment. Brexit-related supply chain interruptions, especially from April is a concern.

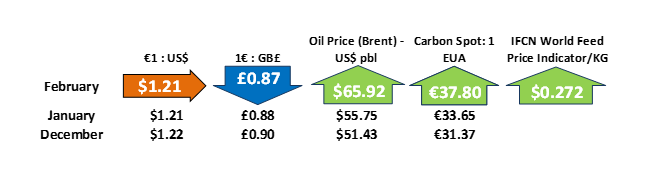

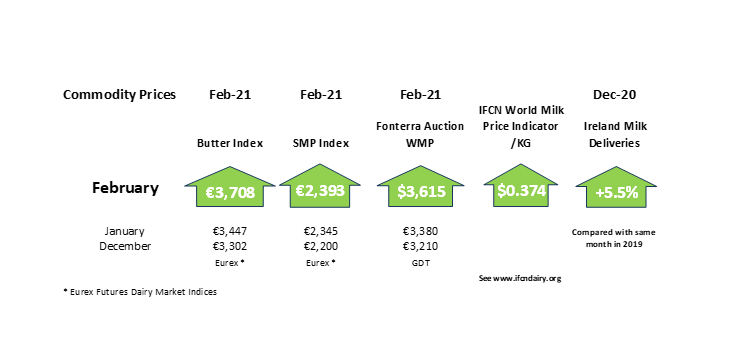

Milk supply will continue to expand in 2021 by 1% to 1.5%. US milk flows are expected to increase by +2% in H1. Milk supply growth in the EU is positive but signs that rising feed and input costs may impact on supply. The positive trends in the GDT index have continued with Oceania prices at a premium to EU prices. The EEX butter index is at €3,708 per tonne with the Dutch price at €3,650 per tonne. The EEX SMP Index is stable at €2,393 per tonne.

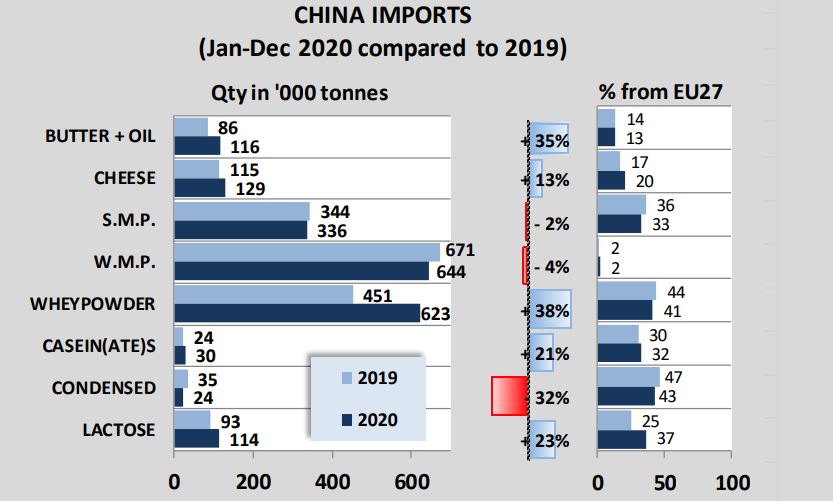

China is the main engine of global demand with butter (+35% y-o-y) and whey powder imports (+38% y-o-y) in 2020. EU exports performed well in 2020, with butter (+15%), cheese (+8%) and WMP (+12%) increasing global market share. SMP exports were down year on year, but still ahead of 2018 figures. The USA, Saudi Arabia and China were the main buyers of EU butter, with Japan still the number one buyer of EU cheese. Algeria was a significant buyer of EU SMP (+26% y-o-y) and WMP (+102% y-o-y) in 2020.