Markets Commentary

Global milk supply is lacklustre (-0.4% year on year), but demand remains weaker than normal, especially in established markets.

In the EU, milk supply increased by +0.3% in Q1, while the Commission predicts cumulative output in 2019 to grow by +0.7%. Supply is robust in Ireland (+15% in Apr), UK (+4.5% in Apr & +1.6% in May) and Poland (+2.8%). However, milk output is constrained in the Netherlands (-1.7% in Apr), France (-0.9%) and Germany (-0.5% in Apr, although March output increased year on year).

In 2018, the EU dairy herd decreased by 1.6% or 374,000 head due to weather and environmental challenges. The Netherlands accounted for one third of the decline due to the introduction of phosphate quotas.

The USDA have revised their annual forecast for 2019 to +0.3% due to declining cow numbers and lower yields. Milk flows are also sluggish in South America and Oceania. New season flows in New Zealand are expected to recover, subject to weather conditions.

Global demand is affected by a slowdown in economic growth, Brexit uncertainty, trade and geo-political conflicts and the impact of non-dairy alternatives.

The EEX Butter Index is €3,992/tonne, with the current traded price reported as being lower. The European Commission reports that butter prices are 31% lower than the same period last year.

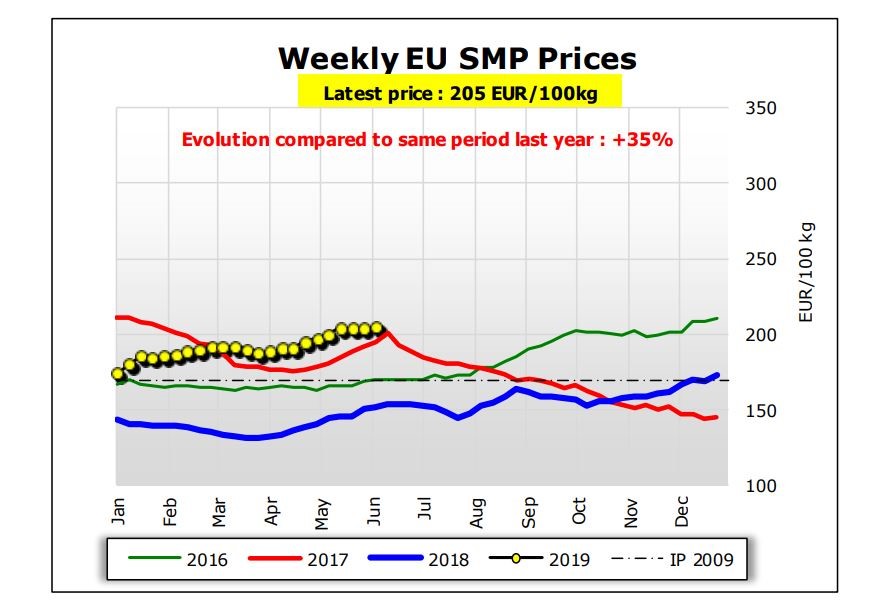

Meanwhile, SMP prices are 35% higher than the same period last year with the EEX Index for SMP at €2,095/ tonne.

Additionally, the European Commission has confirmed that the remaining 162 tonnes of intervention stock has now been cleared to zero, down from nearly 400,000 tonnes, originally purchased by the Commission. Cheese prices are stable but domestic consumption in the EU remains subdued.

Eamonn Farrell – Agri Food Policy Executive